false0001361658Travel & Leisure Co.DEF 14A226,243116,4561,138,870618,37600013616582022-01-012022-12-31iso4217:USD00013616582021-01-012021-12-3100013616582020-01-012020-12-310001361658tnl:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSCTMemberecd:PeoMember2022-01-012022-12-310001361658tnl:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSCTMemberecd:PeoMember2021-01-012021-12-310001361658tnl:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSCTMemberecd:PeoMember2020-01-012020-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatRemainedUnvestedAtYearEndMemberecd:PeoMember2022-01-012022-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatRemainedUnvestedAtYearEndMemberecd:PeoMember2021-01-012021-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatRemainedUnvestedAtYearEndMemberecd:PeoMember2020-01-012020-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToCurrentYearEndOfAwardsGrantedInAnyPriorYearThatRemainedOutstandingAndUnvestedAsOfYearEndMemberecd:PeoMember2022-01-012022-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToCurrentYearEndOfAwardsGrantedInAnyPriorYearThatRemainedOutstandingAndUnvestedAsOfYearEndMemberecd:PeoMember2021-01-012021-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToCurrentYearEndOfAwardsGrantedInAnyPriorYearThatRemainedOutstandingAndUnvestedAsOfYearEndMemberecd:PeoMember2020-01-012020-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInAnyPriorYearThatVestedDuringTheYearMemberecd:PeoMember2022-01-012022-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInAnyPriorYearThatVestedDuringTheYearMemberecd:PeoMember2021-01-012021-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInAnyPriorYearThatVestedDuringTheYearMemberecd:PeoMember2020-01-012020-12-310001361658ecd:PeoMembertnl:IncreaseForDividendsPaidAccruedDuringTheYearPriorToVestingDateMember2022-01-012022-12-310001361658ecd:PeoMembertnl:IncreaseForDividendsPaidAccruedDuringTheYearPriorToVestingDateMember2021-01-012021-12-310001361658ecd:PeoMembertnl:IncreaseForDividendsPaidAccruedDuringTheYearPriorToVestingDateMember2020-01-012020-12-310001361658ecd:PeoMember2022-01-012022-12-310001361658ecd:PeoMember2021-01-012021-12-310001361658ecd:PeoMember2020-01-012020-12-310001361658ecd:NonPeoNeoMembertnl:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSCTMember2022-01-012022-12-310001361658ecd:NonPeoNeoMembertnl:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSCTMember2021-01-012021-12-310001361658ecd:NonPeoNeoMembertnl:DeductionForAmountsReportedUnderTheStockAwardsAndOptionAwardsColumnsInTheSCTMember2020-01-012020-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatRemainedUnvestedAtYearEndMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatRemainedUnvestedAtYearEndMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatRemainedUnvestedAtYearEndMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatThatVestedDuringYearMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatThatVestedDuringYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatThatVestedDuringYearMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToCurrentYearEndOfAwardsGrantedInAnyPriorYearThatRemainedOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToCurrentYearEndOfAwardsGrantedInAnyPriorYearThatRemainedOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToCurrentYearEndOfAwardsGrantedInAnyPriorYearThatRemainedOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInAnyPriorYearThatVestedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInAnyPriorYearThatVestedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001361658tnl:IncreasedeductionForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInAnyPriorYearThatVestedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:NonPeoNeoMembertnl:DeductionForPriorYearFairValueOfAwardsForfeitedDuringTheYearMember2022-01-012022-12-310001361658ecd:NonPeoNeoMembertnl:DeductionForPriorYearFairValueOfAwardsForfeitedDuringTheYearMember2021-01-012021-12-310001361658ecd:NonPeoNeoMembertnl:DeductionForPriorYearFairValueOfAwardsForfeitedDuringTheYearMember2020-01-012020-12-310001361658ecd:NonPeoNeoMembertnl:IncreaseForDividendsPaidAccruedDuringTheYearPriorToVestingDateMember2022-01-012022-12-310001361658ecd:NonPeoNeoMembertnl:IncreaseForDividendsPaidAccruedDuringTheYearPriorToVestingDateMember2021-01-012021-12-310001361658ecd:NonPeoNeoMembertnl:IncreaseForDividendsPaidAccruedDuringTheYearPriorToVestingDateMember2020-01-012020-12-310001361658ecd:NonPeoNeoMember2022-01-012022-12-310001361658ecd:NonPeoNeoMember2021-01-012021-12-310001361658ecd:NonPeoNeoMember2020-01-012020-12-310001361658tnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatThatVestedDuringYearMemberecd:NonPeoNeoMembertnl:NoahBrodskyMember2022-01-012022-12-310001361658tnl:BradDettmerMembertnl:IncreaseForFairValueOfAwardsGrantedDuringYearThatThatVestedDuringYearMemberecd:NonPeoNeoMember2020-01-012020-12-310001361658ecd:NonPeoNeoMembertnl:NoahBrodskyMembertnl:DeductionForPriorYearFairValueOfAwardsForfeitedDuringTheYearMember2022-01-012022-12-310001361658tnl:BradDettmerMemberecd:NonPeoNeoMembertnl:DeductionForPriorYearFairValueOfAwardsForfeitedDuringTheYearMember2020-01-012020-12-31

Use these links to rapidly review the document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) | | | | | | | | |

| | |

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

| | | | | | | | | | | | | | |

| Travel + Leisure Co. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check all boxes that apply): |

| ý | | No fee required. |

| o | | Fee paid previously with preliminary materials. |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

2023 Letter to Shareholders

Travel + Leisure Co.

6277 Sea Harbor Drive

Orlando, FL 32821

April 6, 2023

Dear Fellow Shareholders:

We are pleased to present the Travel + Leisure Co. Proxy Statement and cordially invite you to our 2023 Annual Meeting of Shareholders to be held virtually on Wednesday, May 17, 2023.

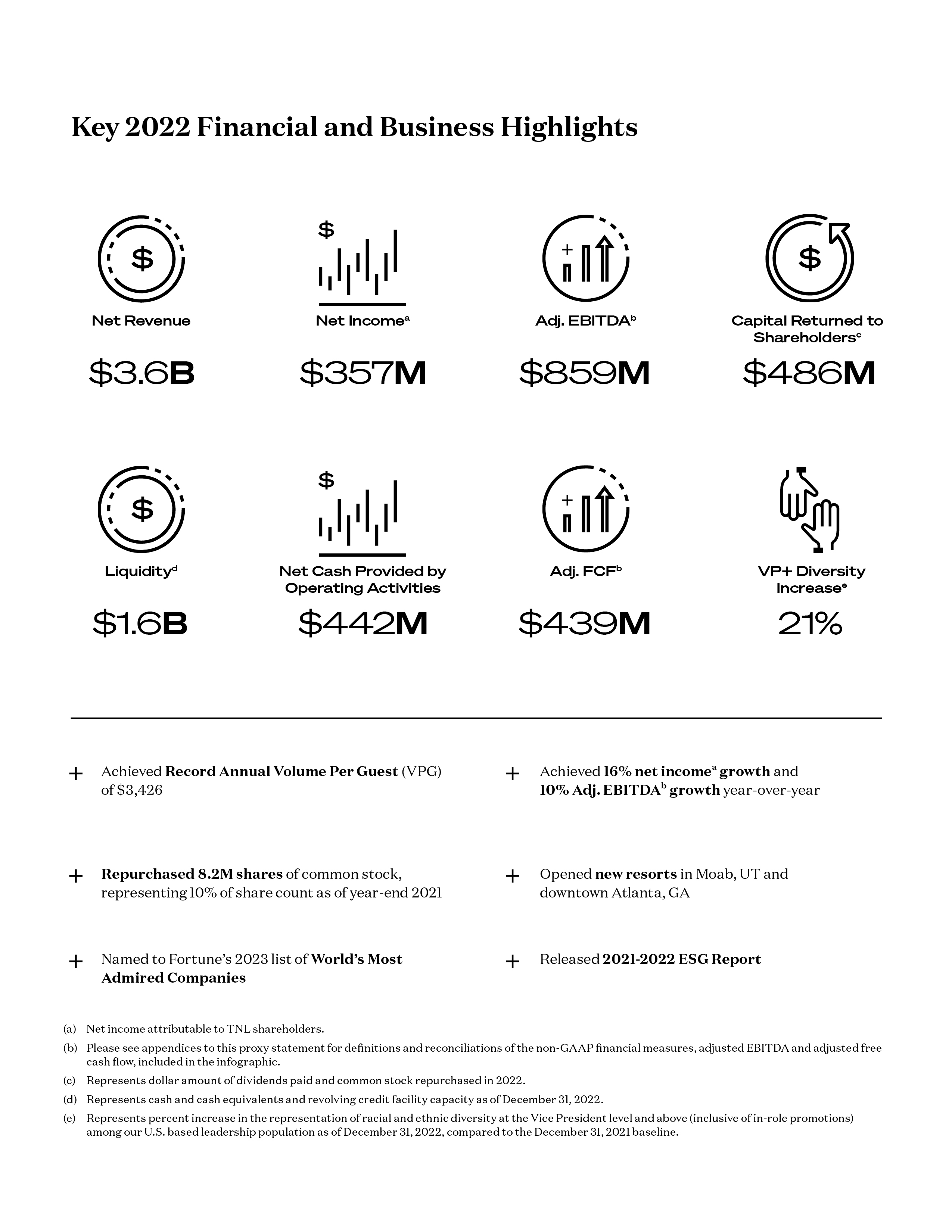

2022 was a solid year – both for our business and the leisure travel industry overall. Consumers prioritized vacations and resoundingly recognized the value of our cornerstone vacation ownership products while we continued to build on the foundation of our travel club businesses. We marked the highest annual sales volume per guest in our Company’s history. Net income, adjusted EBITDA and diluted earnings per share each notched 10% or more year-over-year growth. In 2022, we paid $135 million in dividends and repurchased $351 million of common stock, representing 10% of our year-end 2021 outstanding share count. In short, it was a successful year by many measures, notwithstanding difficult macroeconomic conditions that weighed on shareholder returns and equity markets generally.

Our strong performance would not have been possible without the hard work and dedication of our more than 18,000 associates around the world. Our global team has our sincere thanks and full support.

Crucial to our success is our consumer centric culture, caring for our owners and guests like family. Our flexible, points-based vacation ownership products continue to delight our owners and appeal to new consumers too. Sales transaction mix to new owners increased to 31% in 2022, with millennials and Gen X families representing more than 65% of new owner transactions. We also expanded our 245+ resort portfolio in 2022 with two exciting new destinations – downtown Atlanta, Georgia, and the national parks paradise of Moab, Utah.

We are proud of the progress we have made on important environmental, social and governance (ESG) initiatives too. We intend to highlight our Full Circle ESG strategy and key ESG milestones, including our ongoing commitment to promoting sustainable tourism, in our upcoming 2022-2023 ESG Report. One significant accomplishment is the impact the Travel + Leisure Charitable Foundation has made in the short time since its formation in 2021. The foundation awarded its first college scholarships to high school graduates from Florida’s Eatonville community in 2022 and intends to focus on a variety of programs that include leadership training, mentoring opportunities, and educational support.

Our efforts are being recognized – Forbes named us to their list of the World’s Best Employers for the third year in a row, Newsweek named us as one of America's Most Responsible Companies, and Fortune magazine recently included us on their 2023 list of World’s Most Admired Companies. And just last week, we were named among the Most Trustworthy Companies in America 2023 by Newsweek.

As pleased as we are with the successes of 2022, the Board of Directors and executive team, alongside our associates around the world, remain focused on positioning our leisure-travel focused business for accelerating growth and value creation for our shareholders. We hope you share our optimism about the Company's bright future as we continue to put the world on vacation.

Your vote is very important and we appreciate your support. Whether or not you plan to attend the virtual Annual Meeting of Shareholders, please cast your vote as soon as possible.

Sincerely,

Stephen P. Holmes

Non-Executive Chairman of the Board

Michael D. Brown

President and Chief Executive Officer

TRAVEL + LEISURE CO.

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS

You are invited to participate in Travel + Leisure Co.'s 2023 annual meeting of shareholders. The accompanying proxy materials are being provided to you at the request of the Board of Directors of Travel + Leisure Co. (Board) to encourage eligible shareholders to vote their shares. References in this notice and the accompanying proxy statement to “we,” “us,” “our,” the “Company,” and “Travel + Leisure Co.” refer to Travel + Leisure Co. and our consolidated subsidiaries.

Purpose of the meeting:

•to elect nine Directors for a term expiring at the 2024 annual meeting of shareholders;

•to vote on a non-binding, advisory basis to approve our executive compensation program;

•to vote on a non-binding, advisory basis to determine the frequency with which shareholders are provided an advisory vote to approve our executive compensation program

•to vote on a proposal to ratify the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2023; and

•to transact any other business that may be properly brought before the meeting or any adjournment or postponement of the meeting.

The matters specified for voting above are more fully described in the accompanying proxy statement.

Meeting Information:

| | | | | |

| Date: | Wednesday, May 17, 2023 |

| Time: | 12:30 p.m. Eastern time |

| Place: | Via live webcast - please visit: www.virtualshareholdermeeting.com/TNL2023 |

Who Can Vote:

The record date for the meeting is March 22, 2023. This means that owners of Travel + Leisure Co. common stock at the close of business on that date are entitled to vote at the meeting and any adjournment or postponement of the meeting for which no new record date is set.

How to attend the meeting:

The meeting will begin promptly at 12:30 p.m. Eastern Time on May 17, 2023. Shareholders of record and beneficial holders at the close of business on March 22, 2023 may attend the meeting and vote their shares during the meeting at www.virtualshareholdermeeting.com/TNL2023. Shareholders will have the same opportunities to participate as they would at an in-person meeting with the opportunity to vote and submit questions during the virtual meeting using the directions on the meeting website. Shareholders will need their 16-digit control number to vote or ask questions during the meeting. The control number can be found on the Notice of Internet Availability, proxy card or voting instruction form. Those without a control number may attend as guests of the meeting, but will not have the option to vote their shares or ask questions.

Beneficial shareholders whose shares are registered in the name of a bank, broker or other nominee may need to obtain the information required to be able to participate in, and vote at, the meeting, including their control number, from their bank, broker or other nominee. If a beneficial holder has any questions regarding attendance at the meeting, they should contact their broker, bank or other nominee who holds their shares.

Online access to the meeting will open 15 minutes prior to the start of the meeting to allow time for participants to login and for the testing of device audio systems. We encourage participants to access the meeting in advance of the designated start time. After logging in, please review the rules of conduct for the meeting posted on the website.

Support will be available 15 minutes prior to, and during, the meeting to assist shareholders with any technical difficulties they may have accessing or hearing the virtual meeting. If participants encounter any difficulty, they should call the support team at the numbers listed on the login screen.

Information About the Notice of Internet Availability of Proxy Materials:

Instead of mailing a printed copy of our proxy materials, including our Annual Report, to all of our shareholders, we provide access to these materials in a fast and efficient manner via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all shareholders. Accordingly, on or about April 6, 2023, we will begin mailing a Notice to all shareholders of record as of March 22, 2023, and will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, shareholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Proxy Voting:

We are, on behalf of our Board, soliciting your proxy to vote your shares at our 2023 annual meeting. We solicit proxies to give all shareholders of record an opportunity to vote on matters that will be presented at the annual meeting.

Your vote is important. Please vote your proxy promptly so your shares are represented, even if you plan to attend the annual meeting. You may vote by Internet, by telephone, by requesting a printed copy of the proxy materials and using the enclosed proxy card or at the annual meeting.

Our proxy tabulator, Broadridge Financial Solutions, must receive any proxy that will not be voted at the annual meeting by 11:59 p.m. Eastern time on Tuesday, May 16, 2023. If you have shares of common stock credited to your account under the Company's Employee Savings Plan, the trustees must receive your voting instructions by 11:59 p.m. Eastern time on Friday, May 12, 2023.

By order of the Board of Directors,

James Savina

General Counsel &

Corporate Secretary

April 6, 2023

TABLE OF CONTENTS | | | | | |

| |

| |

Director Skills, Qualifications, Diversity and Refreshment | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROXY STATEMENT

This proxy statement contains information on the following matters that will be presented at the 2023 Annual Meeting of Shareholders (Annual Meeting) and is provided to assist you in voting your shares.

| | | | | | | | | | | |

| VOTING MATTER | BOARD VOTE RECOMMENDATION | PAGE REFERENCE |

Proposal 1: | Election of Directors | FOR ALL of the director nominees | |

Proposal 2: | Advisory approval of our executive compensation program ("say-on-pay vote") | FOR | |

| Proposal 3: | Advisory determination of the frequency of future say-on-pay votes | ONE YEAR | |

Proposal 4: | Ratification of the appointment of the Independent Registered Public Accounting Firm for 2023 | FOR | |

For additional information about the Annual Meeting, please see FAQs about the Annual Meeting on page 53. On or about April 6, 2023, we will begin mailing a Notice of Internet Availability of Proxy Materials (Notice) to all shareholders of record as of March 22, 2023, and will post our proxy materials on the website referenced in the Notice.

PROPOSAL 1: ELECTION OF DIRECTORS

The Travel + Leisure Co. Board of Directors (Board) is comprised of a diverse, highly experienced and engaged group of individuals. The Board has nominated our nine current Directors for election at the Annual Meeting for a term expiring at the 2024 annual meeting of shareholders, consistent with the recommendation of the Corporate Governance Committee.

Each Director nominee has agreed to be named in this proxy statement and if elected to serve until such Director’s successor is elected and qualified or until such Director’s earlier resignation, retirement, disqualification or removal. Accordingly, we do not know of any reason why any nominee would be unable to serve as a Director. If any nominee is unable or unwilling for good cause to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board may nominate to the extent permitted by applicable law or rule.

The following table provides summary information about our Director nominees. Your Board recommends that you vote “FOR” the election of each of the nine nominees. Detailed biographical information about each Director nominee begins on page 4. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Director | | Committee Member |

| Nominee Name & Biography Snapshot | Age | Since | Independent | A | C | E | G |

| Stephen P. Holmes Non-Executive Chairman and former Chairman & CEO Travel + Leisure Co. (f/k/a Wyndham Worldwide Corp.) | 66 | 2006 | | | | + | |

| Louise F. Brady Co-founder and Managing Partner Piedmont Capital Partners, LLC, Piedmont Capital Partners II, LLC, and Piedmont Capital Investments, LLC | 58 | 2016 | ü | l | + | | |

| Michael D. Brown President and Chief Executive Officer Travel + Leisure Co. | 52 | 2018 | | | | l | |

| James E. Buckman Former Vice Chairman York Capital Management | 78 | 2006 | | | l | l | |

| George Herrera President and Chief Executive Officer Herrera-Cristina Group, Ltd. | 66 | 2006 | ü | l | | | + |

| Lucinda C. Martinez Founder Lumark, LLC | 52 | 2021 | ü | | | | l |

| Denny Marie Post Co-President Nextbite | 66 | 2018 | ü | | l | | l |

| Ronald L. Rickles Former Senior Partner Deloitte & Touche LLP | 71 | 2018 | ü | + | | | l |

| Michael H. Wargotz Former Chairman Axcess Ventures | 64 | 2006 | ü | l | l | l | |

Lead Director + Chair l Member A Audit C Compensation E Executive G Corporate Governance Lead Director + Chair l Member A Audit C Compensation E Executive G Corporate Governance |

Director Skills, Qualifications, Diversity and Refreshment

Each Director nominee has the skills, experience and personal qualities the Board seeks in its directors, and the Board believes that the combination of these nominees creates an effective and well-functioning Board.

Following are the key qualifications, attributes and skills our Director nominees collectively bring to the Board:

| | | | | |

•Ability to Make Independent Analytical Inquiries | •Human Capital Management |

•Capacity to Devote Necessary Time to Board Duties | •Integrity, Wisdom and Judgment |

•Executive Leadership | •Legal and Corporate Governance Experience |

•Financial Expertise | •Public Company Board Experience |

•Focus on Promoting Diversity and Inclusion | •Risk Management |

•Global Perspective | •Sales and Marketing Expertise |

•Government and Regulatory Affairs Experience | •Subscription-Based Business Experience |

•Hospitality or Consumer Driven Industry Experience | •Technology Innovation Experience |

The Board recognizes the importance of Board refreshment to achieve the appropriate mix of the institutional knowledge and experience of our longer-tenured Directors together with the fresh perspectives of our newer Directors. Four of nine Directors, comprising 44% of the Board, have joined the Board since 2018, including Ms. Martinez who joined in November 2021.

The Board also believes that it is essential that Directors represent diverse viewpoints, as the judgment and perspectives offered by diverse viewpoints improves the quality of decision-making and enhances the Company’s business performance. Four of nine Directors, comprising 44% of the Board, are female and/or have ethnically diverse backgrounds, including three female Directors (Mss. Brady, Martinez and Post) and two Directors with ethnically diverse backgrounds (Mr. Herrera and Ms. Martinez).

Director Nomination Process

Role of Corporate Governance Committee. The Corporate Governance Committee is responsible for recommending the Director nominees for election to the Board. The Corporate Governance Committee considers the appropriate balance of experience, skills and characteristics required of the Board when considering potential candidates to serve on the Board.

The Corporate Governance Committee does not have a formal policy with respect to diversity; however, the Corporate Governance Committee focuses on issues of diversity, such as diversity of gender, race, ethnicity and national origin, education, professional experience and differences in viewpoints and skills. In considering candidates for the Board, the Corporate Governance Committee considers the entirety of each candidate’s credentials in the context of these standards. For the nomination of continuing Directors for re-election, the Corporate Governance Committee also considers the individual’s contributions to the Board.

All of our Directors bring to our Board a wealth of executive leadership experience derived from their service as senior executives of large organizations as well as board experience. Certain individual qualifications, experience and skills of our Directors that led the Board to conclude that each Director should serve as our Director are described below under "Director Biographies."

Identification and Evaluation Process. The process for identifying and evaluating new nominees to the Board is initiated by identifying a candidate who meets the criteria for selection as a nominee and has the specific qualities or skills being sought, based on input from members of the Board; and, when appropriate, a third-party search firm may be used, which would identify and recommend potential candidates for consideration. The Corporate Governance Committee and other members of the Board will evaluate these candidates by reviewing the candidates’ biographical information and qualifications and checking the candidates’ references. Qualified candidates will be interviewed by at least one member of the Corporate Governance Committee. Using the input from one or more interviews, other Board members and other information it obtains, the Corporate Governance Committee evaluates whether the candidate is qualified to serve as a Director and whether the Corporate Governance Committee should recommend to the Board that the Board nominate the candidate for election by the shareholders or to fill a vacancy or newly created position on the Board.

Shareholder Recommendations of Nominees. The Corporate Governance Committee will consider written recommendations from shareholders for nominees for Director. Recommendations should be submitted to the Corporate Governance Committee, c/o the Corporate Secretary, and include at least the following: name of the shareholder and evidence of the person’s ownership of our common stock, number of shares owned and the length of time of ownership, name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a Director and the person’s consent to be named as a Director if recommended by the Corporate Governance Committee and nominated by the Board. To evaluate nominees for Directors recommended by shareholders, the Corporate Governance Committee intends to use a substantially similar evaluation process as described above.

Shareholder Nominations and By-Law Procedures. Our By-Laws establish procedures pursuant to which a shareholder may nominate a person for election to the Board. Our By-Laws are available on the Investors page of our website at travelandleisureco.com/investors by clicking on the Governance menu followed by the Governance Documents link. To nominate a person for election to the Board, a shareholder must submit a notice containing all information required by our By-Laws regarding the Director nominee and the shareholder and any associated persons making the nomination, including name and address, number of shares owned, a description of any additional interests of such nominee or shareholder and certain representations regarding such nomination. Our By-Laws require that such notice be updated as necessary as of specified dates prior to the annual meeting. We may require any proposed nominee to furnish such other information as we may require to determine his or her eligibility to serve as a Director. Such notice must be accompanied by the proposed nominee’s consent to being named as a nominee and to serve as a Director if elected.

To nominate a person for election to the Board at our 2024 annual meeting, written notice of a shareholder nomination must be delivered to our Corporate Secretary not earlier than January 18, 2024 and not later than February 17, 2024. However, if the date of the 2024 annual meeting is not within 30 days before or after May 17, 2024, then a shareholder’s written notice will be timely if it is delivered by no later than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting is made or the notice of the date of the annual meeting was mailed, whichever occurs first. Our By-Laws require that any such notice be updated as necessary as of specified dates prior to the annual meeting. A shareholder may make nominations of persons for election to the Board at a special meeting if the shareholder delivers written notice to our Corporate Secretary not later than the close of business on the 10th day following the day on which public disclosure of the date such special meeting was made or notice of such special meeting was mailed, whichever occurs first; provided that, at a special meeting of shareholders, only such business may be conducted (including election of directors) as shall have been brought before the meeting under our notice of meeting. In addition to satisfying the requirements under our By-Laws with respect to advance notice of any nomination, any shareholder that intends to solicit proxies in support of director nominees other than the Company's director nominees in accordance with Rule 14a-19 must deliver notice to the Corporate Secretary no later than 60 calendar days prior to the anniversary of the previous year's annual meeting (no later than March 18, 2024 for the 2024 annual meeting of shareholders). Any such notice of intent to solicit proxies must comply with all the requirements of Rule 14a-19.

Voting Standard and Majority Vote Policy

Our Certificate of Incorporation and By-Laws provide for a plurality voting standard for the election of our Directors. Under a plurality voting standard the nominee for each Director position with the most votes is elected. Only votes cast “for” a nominee will be counted. Votes “withheld” and broker non-votes in the election of directors will not be counted as cast for such purpose and therefore will have no effect on the outcome of the election.

Under the Board’s Corporate Governance Guidelines, any nominee for Director in an uncontested election (such as this one where the number of nominees does not exceed the number of Directors to be elected) who receives a greater number of votes withheld from his or her election than votes for such election shall promptly tender his or her resignation following certification of the shareholder vote. The Corporate Governance Committee will promptly consider the tendered resignation and will recommend to the Board whether to accept the tendered resignation or to take some other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the withheld votes. In making this recommendation the Corporate Governance Committee will consider all factors deemed relevant by its members.

The Board will act on the Corporate Governance Committee’s recommendation no later than at its first regularly scheduled meeting following certification of the shareholder vote but in any case no later than 120 days following the certification of the shareholder vote. In considering the Corporate Governance Committee’s recommendation, the Board will review the factors considered by the Corporate Governance Committee and such additional information and factors the Board believes to be relevant. We will promptly publicly disclose the Board’s decision and process in a periodic or current report filed with the SEC. Any Director who tenders his or her resignation under this process will not participate in the Corporate Governance Committee recommendation or Board consideration regarding whether or not to accept the tendered resignation. However, such Director shall remain active and engaged in all other Committee and Board activities, deliberations and decisions during this process.

Director Biographies

Included in the biography for each Director nominee is a description of select key qualifications and experience that led the Board to conclude that each nominee is qualified to serve as a member of the Board. All biographical information below is as of the Record Date.

| | | | | |

| Stephen P. Holmes, 66, has served as the Non-Executive Chairman of the Board since May 2018. Mr. Holmes previously served as our Chairman and Chief Executive Officer from July 2006 until May 2018. Mr. Holmes was Vice Chairman and director of Cendant Corporation and Chairman and Chief Executive Officer of Cendant’s Travel Content Division from December 1997 to July 2006. Mr. Holmes was Vice Chairman of HFS Incorporated (HFS) from September 1996 to December 1997, a director of HFS from June 1994 to December 1997 and Executive Vice President, Treasurer and Chief Financial Officer of HFS from July 1990 to September 1996. Mr. Holmes also currently serves as the Non-Executive Chairman of the Board of Wyndham Hotels & Resorts, Inc. (Wyndham Hotels).

Mr. Holmes’ exceptional leadership as our former CEO provides him with detailed strategic perspective and knowledge of our operations and industry that are critical to the Board’s effectiveness. He possesses extensive public company management experience and is widely recognized as a visionary leader in the global hospitality industry. Under Mr. Holmes’ leadership, we completed the spin-off of Wyndham Hotels and continue to focus our business on, among other things, generating significant earnings and cash flow and building world-renowned hospitality brands, all of which continue to increase shareholder value. Mr. Holmes’ specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Holmes should serve as our Director. |

| | | | | |

| Louise F. Brady, 58, has served as a Director since November 2016. She is a co-founder and has served as the Managing Partner of Piedmont Capital Partners, LLC (PCP), Piedmont Capital Partners II, LLC (PCP II), and Piedmont Capital Investments, LLC (PCI) since March 2013, March 2019 and February 2020, respectively. PCP and PCP II are privately held venture capital funds that focus on developing innovative technologies and PCI is a privately held investment entity that focuses on transformative investments in emerging technology companies. She also currently serves as President of Blue Current, Inc., a position she has held since May 2014, which manufactures advanced solid-state batteries for electric vehicles, consumer electronics, medical and IoT devices. From September 1996 to October 2013, she served as Vice President of Investments at Wells Fargo Advisors Financial Services. Ms. Brady has spent her career focused on leading investment strategies and unlocking growth and value through developing innovative technologies in start-up companies, commercial banking and venture capital portfolio management. Ms. Brady’s exceptional background and skills contribute financial expertise and perspective on innovation to our Board in areas that are important to our business. Ms. Brady’s specific experience, qualifications and skills described above led the Board to conclude that Ms. Brady should serve as our Director. |

| | | | | |

| Michael D. Brown, 52, has served as our President and Chief Executive Officer and as a Director since May 2018. Mr. Brown is responsible for the performance, growth and strategic direction of the world’s leading membership and leisure travel company with a portfolio of nearly 20 resort, travel club, and lifestyle travel brands.

Previously, Mr. Brown served as President and CEO of Wyndham Vacation Ownership from April 2017 until the completion of our spin-off of Wyndham Hotels, following a successful executive leadership tenure at Hilton Grand Vacations (HGV), a global timeshare company, where he served as Chief Operating Officer (COO). Prior to being appointed as COO for HGV in 2014, he held the role of Executive Vice President, Sales and Marketing - Mainland U.S. and Europe. Prior to joining HGV in 2008, Mr. Brown served in a series of sales, development, operations, and finance leadership roles throughout the U.S., Europe and the Caribbean during his more than 16 years at Marriott International and Marriott Vacation Club International. Mr. Brown currently serves as a member of the Orlando Economic Partnership Governor’s Council, the American Resort Development Association (ARDA) Executive Committee, and is Chair of the ARDA Board of Directors. He is also an Advisory Council Member of the Enzian Theatre, and serves on the Hispanic Chamber of Commerce Metro Orlando Board of Directors. A leisure travel industry veteran of more than 25 years, Mr. Brown’s leadership is infused with a combination of strategic vision, operational expertise, authentic engagement, and industry knowledge. In addition, Mr. Brown drives the Company's commitment to be responsive and engaged through socially conscious initiatives, and fosters its global spirit of hospitality and responsible tourism. Mr. Brown’s specific experience, qualifications and skills described above led the Board to conclude that Mr. Brown should serve as our Director. |

| | | | | |

| James E. Buckman, 78, has served as a Director since July 2006 and Lead Director since March 2010. From May 2007 to January 2012, Mr. Buckman served as Vice Chairman of York Capital Management, a hedge fund management company headquartered in New York City. From May 1, 2010 to January 2012, Mr. Buckman also served as General Counsel of York Capital Management and from January 2007 to May 2007 he served as a Senior Consultant to York Capital Management. Mr. Buckman was General Counsel and a director of Cendant from December 1997 to August 2006, Vice Chairman of Cendant from November 1998 to August 2006 and Senior Executive Vice President of Cendant from December 1997 to November 1998. Mr. Buckman was Senior Executive Vice President, General Counsel and Assistant Secretary of HFS Incorporated (HFS) from May 1997 to December 1997, a director of HFS from June 1994 to December 1997 and Executive Vice President, General Counsel and Assistant Secretary of HFS from February 1992 to May 1997. Mr. Buckman has also served as a member of the Wyndham Hotels board of directors since May 2018.

Mr. Buckman brings to the Board exceptional leadership, experience and perspective necessary to be our Lead Director. His service as a director, Vice Chairman and General Counsel of Cendant and a Director of Wyndham Hotels affords Mr. Buckman strong experience with Travel + Leisure Co.’s business and operations. Mr. Buckman’s experience with leading hedge fund manager York Capital Management contributes valuable cross-industry experience and depth of knowledge. Mr. Buckman’s specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Buckman should serve as our Director. |

| | | | | |

| George Herrera, 66, has served as a Director since July 2006. Since December 2003, Mr. Herrera has served as President and Chief Executive Officer of Herrera-Cristina Group, Ltd., a Hispanic-owned, multidisciplinary management firm. From August 1998 to January 2004, Mr. Herrera served as President and Chief Executive Officer of the U.S. Hispanic Chamber of Commerce. Mr. Herrera served as President of David J. Burgos & Associates, Inc. from December 1979 to July 1998. Mr. Herrera served as a director of Cendant from January 2004 to August 2006.

Mr. Herrera provides the Board with exceptional leadership and management knowledge. As a Cendant director and a Director and Chair of the Corporate Governance Committee of Travel + Leisure Co., Mr. Herrera has gained a broad understanding of the role of the Board in our operations. Mr. Herrera’s service as chief executive officer of multidisciplinary management firm Herrera-Cristina Group, Ltd. contributes extensive and varied management, finance and corporate governance experience. His prior service as President and CEO of the U.S. Hispanic Chamber of Commerce brings valuable government relations expertise to the Board. Mr. Herrera’s specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Herrera should serve as our Director. |

| | | | | |

| Lucinda C. Martinez, 52, has served as a Director since November 2021. In May 2022, Ms. Martinez founded Lumark, LLC, a multicultural marketing consulting firm providing media clients with a culture-first strategic approach to driving awareness and engagement across targeted audiences through culturally aligned advertising and promotional tactics. Previously, Ms. Martinez was Vice President, Global Brand & Multicultural Marketing at Netflix, Inc., one of the world’s leading entertainment subscription services, from September 2021 through June 2022, and led the development, strategy and execution of brand transformation, audience engagement, and insight-driven brand positioning within a cultural context for Netflix globally. Prior to that, she spent nearly 20 years with WarnerMedia, a media company with a portfolio of iconic entertainment, news, and sports brands, in roles of increasing responsibility, including serving as Executive Vice President, Brand Marketing HBO and HBO Max from August 2020 to March 2021 and as Executive Vice President, Multicultural Marketing, Brand & Inclusion Strategy from September 2019 to August 2020. During her tenure with Warner Media, she built a best-in-class multicultural marketing team that created meaningful, long-term connections with the brand’s fans across the rapidly changing global marketplace. Ms. Martinez serves on the Board of Trustees of The Alvin Ailey American Dance Theater and on the Advisory Board of The Hispanic Scholarship Fund.

Ms. Martinez is an accomplished media and entertainment industry executive with expertise in the global marketing of subscription businesses for two of the world’s most successful digital media companies, HBO and Netflix. She brings world-class experience in subscriber business development, digital and diverse marketing strategies, and brand management to the Board. Ms. Martinez's specific experience, qualifications, attributes and skills described above led the Board to conclude that Ms. Martinez should serve as our Director. |

| | | | | |

| Denny Marie Post, 66, has served as a Director since May 2018. In June 2022, Ms. Post was named Co-President of Nextbite, a leader in virtual restaurants and the pioneer in online order management. Previously, she served as the Chief Executive Officer of Red Robin Gourmet Burgers Inc., a casual dining restaurant chain, from August 2016 and as President from February 2016 until April 2019. She also serves on the boards of Vital Farms (VITL), Bluestone Lane Holdings, Libbey Glass and P.F. Chang's China Bistro. She previously served as a member of the Red Robin Board of Directors. Prior to serving as President of Red Robin, Ms. Post served as Executive Vice President and Chief Concept Officer of Red Robin beginning in March 2015. Ms. Post joined Red Robin in August 2011 as Senior Vice President and Chief Marketing Officer. Ms. Post has more than 30 years of leadership experience in consumer driven marketing, product innovation and strategic team building. Prior to her role at Red Robin, Ms. Post served as the Senior Vice President and Chief Marketing Officer at T-Mobile USA. Ms. Post previously held the roles of Senior Vice President of Global Beverage, Food and Quality for Starbucks Corporation as well as the Senior Vice President and Chief Concept Officer for Burger King. Ms. Post also held several management positions for KFC USA, KFC, Pizza Hut and Taco Bell Canada while she was employed with YUM! Brands, Inc.

Ms. Post’s more than 30 years of senior management experience in the consumer driven industry brings extensive sales, marketing and management expertise to Travel + Leisure Co. and this is of significant value to the Board. As a member of the Compensation and Governance Committees of Travel + Leisure Co., Ms. Post has gained a broad understanding of the role of the Board in our operations. Ms. Post’s prior service as chief executive officer of a publicly traded company contributes extensive leadership, marketing and brand management experience and provides the Board with expertise that is critical to our business. Ms. Post’s specific experience, qualifications, attributes and skills described above led the Board to conclude that Ms. Post should serve as our Director. |

| | | | | |

| Ronald L. Rickles, 71, has served as a Director since 2018. He was a senior partner with Deloitte & Touche LLP until his retirement in 2014. He served in a variety of leadership roles, including managing partner for the New Jersey offices and Northeast regional leader of the firm’s professional services practice for mid-market and privately held companies. Earlier serving as an audit partner for 30 years, Mr. Rickles was the lead partner serving some of the firm’s most significant clients with deep experience serving the hospitality industry (including timeshare), REITs, retailers, financial services companies and franchisors, including the legacy businesses of Travel + Leisure Co.

Mr. Rickles has significant boardroom experience advising client audit committees on financial reporting, internal controls, investigations and corporate governance. He also has substantial experience and expertise working with and advising senior management on complex transactions, including mergers and acquisitions, sales, and capital market activities. Mr. Rickles’ service as Chair of the Audit Committee together with his extensive financial background and exceptional leadership experience provides the Board with financial accounting and management expertise and perspectives. Mr. Rickles’ specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Rickles should serve as our Director.

|

| | | | | |

| Michael H. Wargotz, 64, has served as a Director since July 2006. Mr. Wargotz is a private investor, involved with various start-up ventures. From July 2011 to June 2017, he was the Chairman of Axcess Ventures, an affiliate of Axcess Worldwide, a brand experience marketing development agency, which he co-founded in 2001. From August 2010 to June 2011, Mr. Wargotz served as the Chief Financial Officer of The Milestone Aviation Group, LLC, a global aviation leasing company. From August 2009 to July 2010, Mr. Wargotz served as the Co-Chairman of Axcess Luxury and Lifestyle. From December 2006 to August 2009, Mr. Wargotz served as the Chief Financial Advisor of NetJets, Inc., a leading provider of private aviation services, and from June 2004 to November 2006, he served as Vice President of NetJets. From January 1998 to December 1999, Mr. Wargotz served in various leadership positions with Cendant, including President and Chief Executive Officer of its Lifestyle Division, Executive Vice President and Chief Financial Officer of its Alliance Marketing Segment and Senior Vice President, Business Development. Prior to 1998, Mr. Wargotz served in various finance and accounting positions at HFS Incorporated, PaineWebber & Co, American Express and Price Waterhouse. Mr. Wargotz has served as a director of Quotient Technology Inc. (NYSE: QUOT), a leading digital promotions and media technology company, since February 2023 and previously served as a director of Resources Connection, Inc. from May 2009 to October 2021 and CST Brands, Inc. from May 2013 to June 2017.

Mr. Wargotz’s senior management experience brings to the Board financial enterprise and branding knowledge. As past Chair of the Audit Committee of Travel + Leisure Co., he contributes financial reporting and compliance expertise and perspective. Mr. Wargotz’s experience provides the Board with exceptional leadership and branding and business development expertise in areas that are critical to our business. Mr. Wargotz’s specific experience, qualifications, attributes and skills described above led the Board to conclude that Mr. Wargotz should serve as our Director. |

| | | | | | | | | | | | | | |

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS |

| A VOTE FOR ALL OF THE DIRECTOR NOMINEES |

ENVIRONMENTAL AND SOCIAL RESPONSIBILITY

The Company's commitment to strong environmental, social responsibility and governance (ESG) principles begins with the Board. Responsibilities for certain ESG matters are incorporated into the charters of the Audit, Compensation and Corporate Governance Committees of the Board, and the full Board receives updates on ESG matters from management and Committee Chairs. We have also integrated the priorities of environmental sustainability, inclusion and diversity, human rights, ethics, philanthropy and community support directly into our operations, while striving to deliver strong performance across our businesses.

Where You Can Find Additional ESG Information

Detailed information about our governance practices is included below under “Governance.” For additional information about our environmental and social responsibility activities and initiatives, see Part I Item 1—Business, Environmental, Social and Governance of our Annual Report filed with the SEC, which can be found on our website at investor.travelandleisureco.com/sec-filings/annual-reports, and visit our website at investor.travelandleisureco.com/esg. Information from our website is not incorporated by reference into this proxy statement.

GOVERNANCE

Board of Directors

The Board is the ultimate decision-making body of the Company, except for those matters reserved for shareholders by law or pursuant to the Company’s governance instruments and those matters delegated by the Board to management. The Board is committed to exercising sound corporate governance principles and has adopted Corporate Governance Guidelines that, along with the charters of the Committees of the Board, Director Independence Criteria, Code of Conduct for associates, and Code of Business Conduct and Ethics for Directors, provide the framework for our governance. Each document is available on the Investors page of our website at travelandleisureco.com/investors by clicking on the Governance menu followed by the Governance Documents link. The governance rules for companies listed on the New York Stock Exchange and those contained

in the Securities and Exchange Commission (SEC) rules and regulations are reflected in the guidelines. The Board reviews these principles and other aspects of governance periodically.

Board Leadership Structure and Lead Director

While the Board has not mandated a particular leadership structure, historically, the positions of Chairman of the Board and CEO were held by the same person. In 2018, as a result of Mr. Holmes’ discussions with the Board about resigning as our CEO in connection with the spin-off of Wyndham Hotels and as part of its ongoing review of the Board leadership structure and succession planning process, the Board determined that the positions of Chairman and CEO should be held by separate individuals. In connection with the spin-off, effective as of May 31, 2018, the Board elected Mr. Holmes, who had served as the Chairman and CEO of the Company since July 2006, to the position of Non-Executive Chairman of the Board. At the same time, the Board also appointed Mr. Brown, our new President and CEO, as a member of our Board.

In his role, Mr. Holmes provides leadership to the Board by, among other things, working with the CEO, the Lead Director, and the Corporate Secretary to set Board calendars, determine agendas for Board meetings, ensure proper flow of information to Board members, facilitate effective operation of the Board and its Committees, help promote Board succession planning and the orientation of new Directors, address issues of Director performance, assist in consideration and Board adoption of the Company’s long-term and annual operating plans, and help promote senior management succession planning. Mr. Holmes’ experience as our former CEO and his knowledge and familiarity with our business and industry bring unique and valuable perspective to the Board. In addition, Mr. Brown’s service as a Director promotes strategy development and execution and facilitates information flow between management and the Board, which is also essential to effective governance.

The Board also recognizes the importance of having independent Board leadership and selected James E. Buckman, an independent Director who serves as a member of the Executive Committee and Compensation Committee, to serve as the Board’s Lead Director. The Lead Director serves as a key advisor to our Chairman, chairs executive sessions of independent Directors and provides feedback to the Chairman, chairs meetings of the Board in the absence of the Chairman, and reviews in advance, and as appropriate, consults with the Chairman regarding, the agendas for all Board and Committee meetings.

Seven of our nine current Directors are independent, and the Audit, Compensation and Corporate Governance Committees are comprised solely of independent Directors. Consequently, the independent Directors directly oversee such critical items as the Company’s financial statements, executive compensation, the selection and evaluation of Directors and the development and implementation of our corporate governance programs. Our independent Directors bring experience, oversight and expertise from outside our Company and industry, which balances the Company-specific experience and expertise that our Non-Executive Chairman and our CEO bring to the Board.

The Board will continue to review our Board leadership structure as part of the succession planning process. We believe that our leadership structure, in which the roles of Chairman and CEO are held by separate individuals, together with an experienced and engaged Lead Director and independent key Committees, is the optimal structure for our Company and our shareholders at this time.

Committees of the Board

The Board has four standing Committees: Audit, Compensation, Corporate Governance and Executive. The key responsibilities of each Committee, together with current membership and the number of meetings held in 2022, are set forth below. | | | | | | | | |

| Audit Committee | |

Committee Members: | Key Responsibilities: |

Ronald L. Rickles (Chair) Louise F. Brady George Herrera Michael H. Wargotz

Meetings in 2022: 9

| •Appointing our independent registered public accounting firm to perform an integrated audit of our consolidated financial statements and internal control over financial reporting. •Pre-approving all services performed by our independent registered public accounting firm. •Providing oversight on the external reporting process and the adequacy of our internal controls. •Reviewing the scope, planning, staffing and budgets of the audit activities of the independent registered public accounting firm and our internal auditors. | •Reviewing services provided by our independent registered public accounting firm and other disclosed relationships as they bear on the independence of our independent registered public accounting firm, and providing oversight on hiring policies with respect to employees or former employees of the independent auditor. •Maintaining procedures for the receipt, retention and resolution of complaints regarding accounting, internal controls and auditing matters. •Reviewing and updating periodically our Code of Conduct to promote ethical behavior by all of our associates. •Review and provide oversight of related person transactions in compliance with the Company’s Related Person Transactions Policy. |

| Financial Expertise, Independence, and Financial Literacy All members of the Audit Committee are independent under the Board’s Director Independence Criteria and applicable regulatory and listing standards, as well as financially literate, knowledgeable and qualified to review financial statements in accordance with applicable regulatory and listing standards. Ronald L. Rickles and Michael H. Wargotz are audit committee financial experts within the meaning of applicable SEC rules and have “accounting or related financial management expertise” within the meaning of applicable NYSE rules. |

| | | | | | | | |

Compensation Committee | |

Committee Members: | Key Responsibilities: |

Louise F. Brady (Chair) James Buckman Denny Marie Post Michael H. Wargotz

Meetings in 2022: 5

| •Providing oversight on our executive compensation program consistent with corporate objectives and shareholder interests. •Reviewing and approving Chief Executive Officer (CEO) and other senior management compensation. •Reviewing and considering the independence of advisers to the Compensation Committee. | •Approving grants of long-term incentive awards and our senior executives’ annual incentive compensation under our compensation plans. •Periodically reviewing our human capital programs, policies and procedures (except to the extent within the purview of the Corporate Governance Committee), including management succession planning and development.

|

| Independence and Non-Employee Director Status All of the members of the Compensation Committee are independent under the Board’s Director Independence Criteria and applicable regulatory and listing standards. Each member also qualifies as a “non-employee director” for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (Exchange Act).

Compensation Committee Interlocks and Insider Participation There are no compensation committee interlocks between Travel + Leisure Co. and other entities involving our executive officers and directors. |

| | | | | | | | |

| Corporate Governance Committee | |

Committee Members: | Key Responsibilities: |

George Herrera (Chair) Lucinda C. Martinez Denny Marie Post Ronald L. Rickles Meetings in 2022: 4

| •Recommending to the Board nominees for election to the Board. •Reviewing principles, policies and procedures affecting Directors and the Board’s operation and effectiveness. •Providing oversight on the evaluation of the Board and its effectiveness. | •Reviewing matters of corporate social responsibility and sustainability performance, including potential long- and short-term trends and impacts of environmental, social, and governance issues. •Reviewing and approving Director compensation. |

| Independence All of the members of the Corporate Governance Committee are independent under the Board’s Director Independence Criteria and applicable listing standards. |

| | | | | | | | |

Executive Committee | |

Committee Members: | Key Responsibilities: |

Stephen P. Holmes (Chair) Michael D. Brown James Buckman Michael H. Wargotz

Meetings in 2022: 7 | The Executive Committee may exercise all of the authority of the Board when the Board is not in session, except that the Executive Committee does not have the authority to take any action which legally or under our internal governance policies may be taken only by the full Board. |

The charters of the Audit, Compensation and Corporate Governance Committees are available on the Investor page of our website at travelandleisureco.com/investors by clicking on the Governance menu followed by the Governance Documents link.

Oversight of Risk Management

We face a broad array of risks, including risks relating to our finances, business operations and strategy, human capital matters, legal, regulatory and compliance matters, and reputational exposure. Our CEO and other members of senior management are primarily responsible for day-to-day risk management analysis and mitigation and report to the full Board or the relevant Committee regarding risk management. The Board provides oversight and seeks to ensure that risks undertaken by the

Company are consistent with a level of risk that is appropriate and aligned with the achievement of our business objectives and strategies. Committees of the Board consider risks within their principal areas of responsibility and update the Board on significant risk matters. Aligning Committees with risk oversight in their individualized areas of Committee focus and attention allows the Board to provide specific attention to and oversight of key risk areas.

Each Committee is responsible for providing oversight with respect to the management of certain risks and the entire Board is regularly informed about our risks through Committee reports and management presentations. The Audit Committee provides oversight on our programs for risk assessment and risk management, including with respect to financial accounting and reporting, internal audit, information technology, cybersecurity and ethics and compliance. The Audit Committee also receives quarterly updates from management regarding our global risk assessment (GRA) program, which is designed to identify the top risks applicable to the Company and document risk mitigation plans and initiatives by management. With respect to cybersecurity risk oversight, our Audit Committee receives quarterly updates from the appropriate managers on the primary cybersecurity risks facing the Company and the measures the Company is taking to mitigate such risks. In addition to such periodic reports, our Audit Committee receives updates from management regarding any significant changes to the Company’s cybersecurity risk profile or significant newly identified risks. Our Chief Ethics and Compliance Officer, who is a direct report to our General Counsel, also provides quarterly reports to the Audit Committee with regard to our ethics and compliance program. The Compensation Committee provides oversight on our assessment and management of risks relating to our executive compensation and management succession planning. The Corporate Governance Committee provides oversight on our management of risks associated with the independence of the Board and potential conflicts of interest. The Corporate Governance Committee also periodically reviews matters of corporate social responsibility and sustainability performance, including potential long- and short-term trends and impacts of environmental, social, and governance issues.

Our leadership structure, with Mr. Holmes serving as our Non-Executive Chairman and with Mr. Brown serving as a Director, also enhances the Board’s effectiveness in risk oversight due to the extensive knowledge of Mr. Holmes and Mr. Brown with respect to our business and operations, facilitating the Board’s oversight of key risks. We believe this division of responsibility and leadership structure is the most effective approach for addressing our risk management.

Director Independence

Travel + Leisure Co.’s Corporate Governance Guidelines and Director Independence Criteria define our standards for director independence and reflect applicable NYSE and SEC requirements. All members of the Audit Committee and the Compensation Committee must also meet heightened independence standards under applicable NYSE and SEC rules.

Our Board is required under NYSE rules to affirmatively determine that each independent Director has no material relationship with Travel + Leisure Co., impacting his or her independence.

In accordance with these standards and criteria, the Board undertook its annual review of the independence of its Directors. During this review the Board considered whether there are any relationships or related party transactions between each Director, any member of his or her immediate family or other affiliated entities and us and our subsidiaries and affiliates. The purpose of this review was to determine whether any such relationships or transactions existed that were inconsistent with a determination that the Director is independent.

The Board follows a number of procedures to review related party transactions. We maintain a written policy governing related party transactions that requires Audit Committee pre-approval of related party transactions exceeding $120,000. Each Board member answers a questionnaire designed to disclose conflicts and related party transactions. We also review our internal records for related party transactions. Based on a review of these standards and materials, none of our independent Directors had or has any relationship with us other than as a Director within the meaning of our Director Independence Criteria and applicable regulatory and listing standards.

As a result of its review the Board affirmatively determined that the following Directors are independent of us and our management as required by the NYSE listing standards and the Director Independence Criteria: Louise F. Brady, James E. Buckman, George Herrera, Lucinda C. Martinez, Denny Marie Post, Ronald L. Rickles and Michael H. Wargotz. All members of the Audit, Compensation and Corporate Governance Committees are independent Directors within the meaning of our Director Independence Criteria and applicable regulatory and listing standards.

Executive Sessions of Non-Management Directors and Independent Directors

The non-management members of the Board meet regularly without any members of management present. In addition, at least once a year, the independent Directors meet in a private session that excludes management and non-independent Directors. The Lead Director chairs these sessions.

Meeting Attendance

Directors are expected to attend all Board meetings and meetings of the Committees on which they serve, as well as our Annual Meeting of Shareholders, absent exceptional cause. Directors fulfill their responsibilities not only by attending Board and Committee meetings but also through communication with the Non-Executive Chairman, Lead Director, CEO and other members of management relative to matters of interest and concern to Travel + Leisure Co. throughout the year.

The Board held five meetings during 2022. Each Director attended our 2022 annual meeting of shareholders, and each Director attended all of the Board meetings and at least 78% of the meetings of the committees of the Board on which the Director served during 2022.

All directors are expected to attend the 2023 Annual Meeting.

Communications with the Board and Directors

Shareholders and other parties interested in communicating directly with the Board, an individual non-management or independent Director or the non-management or independent Directors as a group may do so by writing our Corporate Secretary at our principal executive offices at Travel + Leisure Co., 6277 Sea Harbor Drive, Orlando, Florida 32821. The Corporate Secretary will forward the correspondence only to the intended recipients. However, prior to forwarding any correspondence, the Corporate Secretary will review it and in his discretion will not forward correspondence deemed to be of a commercial nature or otherwise not appropriate for review by the Directors.

Compensation of Directors

Highlights of Our Director Compensation Program. The following are highlights of our compensation program for non-management Directors:

•On average, 60% of our Directors’ total annual compensation for 2022 was equity-based, aligning our Directors’ interests with the long-term interests of our shareholders.

•Our Directors have the opportunity to defer all of their cash- and equity-based compensation under our Non-Employee Directors Deferred Compensation Plan. Amounts deferred under the plan are credited in the form of deferred stock units (DSUs) which are payable solely in shares of our common stock. DSUs are not paid out until the Director’s retirement or termination from service on the Board, thereby further aligning our Directors’ interests with the long-term interests of our shareholders. For 2022, our Directors elected to defer on average 43% of their total annual compensation.

•Consistent with Travel + Leisure Co.’s philanthropic commitment, our non-management Directors are provided a three-for-one Company match for charitable contributions. We will match Director contributions $3 for every $1 contributed by the Director up to an aggregate maximum Company contribution of $75,000 per year. On average, 9% of our Directors’ total annual compensation for 2022 was attributable to this charitable match.

•We maintain robust stock ownership guidelines which require our non-management Directors to own stock equal to the greater of 5x the cash portion of the annual retainer or 2.5x their total retainer value without regard to Committee fees. As of December 31, 2022, each of our Directors owned at least 13.4x the cash portion of their annual retainer and 6.7x their total retainer value, except for Ms. Martinez who joined our Board in November 2021 and has until November 2026 to achieve compliance.

•Our 2006 Equity and Incentive Plan, as amended and restated, contains a shareholder-approved limit on the value of equity awards that can be granted to each non-management Director annually.

•We do not pay any per-meeting fees.

•We do not provide retirement benefits to our non-management Directors.

•Our independent compensation consultant reviews our Director compensation program annually relative to our peer group and best practices.

Overview. Non-management Directors receive compensation for Board service designed to compensate them for their Board responsibilities and align their interests with the interests of shareholders. A management Director receives no additional compensation for Board service.

Directors of a publicly traded company have substantial responsibilities and time commitments, and with ongoing changes in corporate governance standards, highly qualified and experienced directors are in high demand. Accordingly, we seek to provide competitive and appropriate economic incentives for our Directors who play a critical and active role in overseeing the management of our Company and guiding our business strategy. Our Board has a total of nine members, seven of whom are independent. Based on 2022 proxy statement data, our peer group companies have, on average, a total of 10 directors and eight independent directors. All of our independent Directors serve on at least one Committee. Our Director compensation program is designed to reasonably compensate our Directors for their qualifications and experience, continued performance, dedication, increased responsibilities and time commitment.

Annual Review of Director Compensation. In November 2021, our independent compensation consultant, Aon, provided an independent review of our non-management Director compensation program. As part of this review, Aon assessed the elements of our program, including annual board retainers in cash and equity, fees for chairman and Committee service, and prevalence of features such as non-executive chairman and lead director pay and other compensation in the form of perquisites and benefits, and provided peer group data (using the peer group listed below in "Compensation Review and Competitive Analysis - Peer Group Composition for 2022") that presented annual retainer fees, Committee service pay, and annual equity grant value at the 25th, 50th and 75th percentile. Aon also assessed the prevalence of governance policies such as stock ownership guidelines and stock hedging/pledging. The Governance Committee reviewed the peer group data prepared by Aon and determined that our Directors' total direct compensation was generally aligned with the philosophy of targeting the top quartile of the peer group. As a result of this review, our 2022 Director compensation program remained consistent with our 2021 program.

Annual Retainer Fees. The following table describes 2022 annual retainer and Committee chair and membership fees for non-management Directors for the full-year. Our Directors do not receive additional fees for attending Board or Committee meetings. | | | | | | | | | | | | | | | | | | | | |

| | Cash-Based | | Stock-Based | | Total |

| Non-Executive Chairman | | $ | 160,000 | | | $ | 160,000 | | | $ | 320,000 | |

| Lead Director | | $ | 132,500 | | | $ | 132,500 | | | $ | 265,000 | |

| Director | | $ | 105,000 | | | $ | 105,000 | | | $ | 210,000 | |

| Audit Committee chair | | $ | 22,500 | | | $ | 22,500 | | | $ | 45,000 | |

| Audit Committee member | | $ | 12,500 | | | $ | 12,500 | | | $ | 25,000 | |

| Compensation Committee chair | | $ | 17,500 | | | $ | 17,500 | | | $ | 35,000 | |

| Compensation Committee member | | $ | 10,000 | | | $ | 10,000 | | | $ | 20,000 | |

| Corporate Governance Committee chair | | $ | 15,000 | | | $ | 15,000 | | | $ | 30,000 | |

| Corporate Governance Committee member | | $ | 8,750 | | | $ | 8,750 | | | $ | 17,500 | |

| Executive Committee member | | $ | 10,000 | | | $ | 10,000 | | | $ | 20,000 | |

The annual Director retainer and Committee chair and membership fees are paid on a quarterly basis 50% in cash and 50% in Travel + Leisure Co. stock. The requirement for Directors to receive at least 50% of their fees in our equity further aligns their interests with those of our shareholders. The number of shares of stock issued is based on our stock price on the quarterly determination date. Directors may elect to receive the stock-based portion of their fees in the form of common stock or deferred stock units (DSUs). Directors may also elect to defer any cash-based compensation or time-vesting restricted stock units (RSUs) into DSUs. A DSU entitles the Director to receive one share of common stock following the Director’s retirement or termination of service from the Board for any reason and is credited with dividend equivalents during the deferral period. The Director may not sell or receive value from any DSU prior to retirement or termination of service.

Director Equity Awards. In addition to the annual retainer fees, to further align our Directors’ interests with those of our shareholders, each non-management Director is granted an annual equity award typically in the form of RSUs. On March 1, 2022, each of our non-management Directors received a $100,000 annual equity grant of time-vesting RSUs, which vest ratably over a four-year period. RSUs are credited with dividend equivalents subject to the same vesting restrictions as the underlying units.

The Corporate Governance Committee elected to approve an increase to the annual equity grant for non-management Directors from $100,000 to $125,000 for 2023. The annual equity grant for non-management Directors is in the form of time-vesting RSUs, which vest ratably over a four-year period.

Other Compensation. Consistent with Travel + Leisure Co.’s philanthropic commitment, we will match non-management Director's qualifying charitable contributions $3 for every $1 contributed by the Director up to an aggregate maximum Company contribution of $75,000 per year. Six of our Directors chose to make qualifying charitable contributions in 2022, which we matched three times the amount of their personal contribution. This benefit to our non-management Directors reflects our core commitment to charitable giving. We also maintain a policy to award our non-management Directors up to a maximum of 500,000 Wyndham Rewards Points annually. These Wyndham Rewards Points have an approximate value of $4,130 and may be redeemed for numerous rewards options including stays at Wyndham properties. This benefit provides our Directors with an opportunity to get ongoing, first-hand exposure to our properties and operations, furthering their understanding and evaluation of our businesses.

Holmes Letter Agreement. In connection with the spin-off of Wyndham Hotels, effective as of May 31, 2018, the Board elected Stephen P. Holmes, who had served as the Chairman and CEO of the Company since July 2006, to the position of Non-Executive Chairman of the Board. In connection with his election as Non-Executive Chairman of the Board, on June 1, 2018, the Company entered into a letter agreement with Mr. Holmes (Holmes Letter Agreement), which provides him with an annual retainer of $320,000 (with $160,000 payable in the form of cash and $160,000 payable in the form of Travel + Leisure Co. common stock) as further described above. In addition, the Company agreed to pay Mr. Holmes the following amounts to assist him in the course of performing his duties and responsibilities to the Company: $18,750 per year toward his costs incurred in connection with retaining an administrative assistant and $12,500 per year toward his costs incurred in connection with office space. In addition, Mr. Holmes was allowed to continue to participate in the Company's executive car lease program, with the Company covering 50% of cost of the lease entered into prior to Mr. Holmes stepping down as Chairman and CEO ($3,552 in 2022), through the earlier of the conclusion of his service and the conclusion of the lease term. Mr. Holmes elected to purchase his car in 2022 at the end of his lease at depreciated book value. In addition, the Company also agreed to reimburse Mr. Holmes while he remains a Board member for 50% of the cost of his annual executive health and wellness physical ($2,250 in 2022).

Director Stock Ownership Guidelines. The Corporate Governance Guidelines require each non-management Director to comply with Travel + Leisure Co.’s Non-Management Director Stock Ownership Guidelines. These guidelines require each non-management Director to beneficially own an amount of our stock equal to the greater of a multiple of at least 5x the cash portion of the annual retainer or 2.5x the total retainer value without regard to Board Committee fees. Directors have a period of five years after joining the Board to achieve compliance with this ownership requirement. DSUs and RSUs credited to a Director count towards satisfaction of the guidelines. As of December 31, 2022, all of our non-management Directors exceeded these stock ownership requirements, except for Ms. Martinez who joined our Board in November 2021 and has until November 2026 to achieve compliance.

2022 Director Compensation Table

The following table describes compensation we paid our non-management Directors for 2022.

| | | | | | | | | | | | | | |

| Directors | Fees Paid

in Cash

($) | Stock Awards ($)(a)(b) | All Other Compensation ($)(c) | Total

($) |

| Louise F. Brady | — | | 369,981 | | 76,404 | | 446,385 | |

| James E. Buckman - Lead Director | 152,617 | | 252,365 | | 78,005 | | 482,987 | |

| George Herrera | 132,556 | | 232,418 | | 13,130 | | 378,104 | |

| Stephen P. Holmes - Chairman | 170,088 | | 269,896 | | 40,417 | | 480,401 | |

| Lucinda C. Martinez | 113,866 | | 213,630 | | 40,108 | | 367,604 | |

| Denny Marie Post | 123,815 | | 223,650 | | 79,130 | | 426,595 | |

| Ronald L. Rickles | 136,352 | | 236,140 | | 2,974 | | 375,466 | |

| Michael H. Wargotz | 137,613 | | 237,354 | | 66,745 | | 441,712 | |