UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant

þ

Filed by a Party other than the

Registrant o

Check the appropriate box:

| |

|

|

|

|

|

o Preliminary

Proxy Statement

|

|

|

o Confidential,

For Use of the Commission Only

|

|

|

x Definitive

Proxy Statement

|

|

|

(as permitted by

Rule 14a-6(e)(2))

|

|

|

o Definitive

Additional Materials

|

|

|

|

|

|

o Soliciting

Material Pursuant to

§240.14a-12

|

|

|

|

|

Wyndham Worldwide

Corporation

(Name of Registrant as Specified

In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

|

| x

|

No fee required.

|

| |

| o

|

Fee computed on table below per Exchange Act

Rules 14a-6(i)(1)

and 0-11.

|

|

|

|

| |

(1)

|

Title of each class of securities to which the transaction

applies:

|

|

|

|

| |

(2)

|

Aggregate number of securities to which the transaction applies:

|

|

|

|

| |

(3)

|

Per unit price or other underlying value of the transaction

computed pursuant to Exchange Act

Rule 0-11

(set forth the amount on which the filing fee is calculated and

state how it was determined):

|

|

|

|

| |

(4)

|

Proposed maximum aggregate value of the transaction:

|

|

|

| o

|

Fee paid previously with preliminary materials.

|

| |

| o

|

Check box if any part of the fee is offset as provided by

Exchange Act

Rule 0-11(a)(2)

and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its

filing.

|

|

|

|

| |

(1)

|

Amount Previously Paid:

|

|

|

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

NOTICE OF 2009 ANNUAL

MEETING

OF SHAREHOLDERS AND

PROXY STATEMENT

Wyndham Worldwide Corporation

22 Sylvan Way

Parsippany, New Jersey 07054

April 1, 2009

Dear Shareholder of Wyndham Worldwide Corporation,

You are cordially invited to attend the 2009 Annual Meeting of

Shareholders to be held on Tuesday, May 12, 2009.

The meeting will start at 2:00 p.m. local time at Birchwood

Manor, 111 North Jefferson Road, Whippany, New Jersey 07981.

I appreciate your continued support of Wyndham Worldwide

Corporation and look forward to seeing you on May 12, 2009.

Very truly yours,

Stephen P. Holmes

Chairman and Chief Executive Officer

WYNDHAM WORLDWIDE

CORPORATION

NOTICE OF 2009

ANNUAL MEETING OF SHAREHOLDERS

April 1, 2009

| |

|

|

|

Date:

|

Tuesday, May 12, 2009

|

|

Time:

|

2:00 p.m. local time

|

|

Place:

|

Birchwood Manor

111 North Jefferson Road

Whippany, New Jersey

07981

|

Purposes of the

meeting:

|

|

| •

|

to elect three directors for a three-year term;

|

| |

| •

|

to vote on a proposal to ratify the appointment of

Deloitte & Touche LLP to serve as our independent

registered public accounting firm for fiscal year 2009;

|

| |

| •

|

to vote on a proposal to approve the amendment and restatement

of the Wyndham Worldwide Corporation 2006 Equity and Incentive

Plan primarily for purposes of Section 162(m) of the

Internal Revenue Code;

|

| |

| •

|

to vote on two shareholder proposals; and

|

| |

| •

|

to transact any other business that may be properly brought

before the meeting or any adjournment or postponement of the

meeting.

|

The matters specified for voting above are more fully described

in the attached proxy statement. Only our shareholders of record

at the close of business on March 16, 2009 will be entitled

to notice of and to vote at the meeting and any adjournments.

Who may attend

the meeting:

Only shareholders, persons holding proxies from shareholders,

invited representatives of the media and financial community and

other guests of Wyndham Worldwide Corporation may attend the

meeting.

What to bring:

If you received (or requested and received) a printed copy of

the proxy materials, you should bring the enclosed Admission

Ticket to gain admission to the meeting. If you received a

Notice of Internet Availability of Proxy Materials (Notice) or

voting instructions and will not be requesting a printed copy of

the proxy materials, please bring the Notice or voting

instructions with you as your Admission Ticket. You must bring

with you a picture identification such as a valid driver’s

license or passport for purposes of personal identification.

If your shares are held in the name of a broker, trust, bank

or other nominee, you will also need to bring a proxy, letter or

recent account statement from that broker, trust, bank or

nominee that confirms that you are the beneficial owner of those

shares.

Record

Date:

March 16, 2009 is the record date for the meeting. This

means that owners of Wyndham Worldwide common stock at the close

of business on that date are entitled to:

|

|

| •

|

receive notice of the meeting; and

|

| |

| •

|

vote at the meeting and any adjournments or postponements of the

meeting.

|

Information About

the Notice of Internet Availability of Proxy

Materials:

This year, instead of mailing a printed copy of our proxy

materials, including our Annual Report, to all of our

shareholders, we have decided to provide access to these

materials in a fast and efficient manner via the Internet. This

reduces the amount of paper necessary to produce these

materials, as well as the costs associated with mailing these

materials to all shareholders. Accordingly, on or about

April 2, 2009, we will begin mailing a Notice to all

shareholders owning less than 1,000 shares as of

March 16, 2009, and will post our proxy materials on the

website referenced in the Notice. As more fully described in the

Notice, shareholders may choose to access our proxy materials on

the website referred to in the Notice or may request to receive

a printed set of our proxy materials. In addition, the Notice

and website provide information regarding how you may request to

receive proxy materials in printed form by mail or

electronically by email on an ongoing basis.

Householding

Information:

We have adopted a procedure approved by the Securities and

Exchange Commission called “householding.” Under this

procedure, shareholders of record who have the same address and

last name and have not previously requested electronic delivery

of proxy materials will receive a single envelope containing the

Notices for all shareholders having that address. The Notice for

each shareholder will include that shareholder’s unique

control number needed to vote his or her shares. This procedure

will reduce our printing costs and postage fees.

If, in the future, you do not wish to participate in

householding and prefer to receive your Notice in a separate

envelope, please contact our transfer agent, BNY Mellon

Shareowner Services, by calling their toll-free number at

(800) 504-8998

or through their website at

www.bnymellon.com/shareowner/isd.

For those shareholders who have the same address and last name

and who request to receive a printed copy of the proxy materials

by mail, we will send only one copy of such materials to each

address unless one or more of those shareholders notifies us, in

the same manner described above, that they wish to receive a

printed copy for each shareholder at that address.

Beneficial shareholders may request information about

householding from their banks, brokers or other holders of

record.

Proxy Voting:

Your vote is important. Please vote your proxy promptly so

your shares can be represented, even if you plan to attend the

annual meeting. You can vote by Internet, by telephone, by

requesting a printed copy of the proxy materials and using the

enclosed proxy card or in person at the annual meeting.

Our proxy tabulator, Mellon Investor Services LLC, must

receive any proxy that will not be delivered in person to the

annual meeting by 11:59 p.m., Eastern Daylight Time on

Monday, May 11, 2009.

By order of the Board of Directors,

Lynn A. Feldman

Corporate Secretary

TABLE OF

CONTENTS

| |

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

1

|

|

|

|

|

|

1

|

|

|

|

|

|

1

|

|

|

|

|

|

2

|

|

|

|

|

|

2

|

|

|

|

|

|

2

|

|

|

|

|

|

3

|

|

|

|

|

|

3

|

|

|

|

|

|

3

|

|

|

|

|

|

3

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

5

|

|

|

|

|

|

5

|

|

|

|

|

|

6

|

|

|

|

|

|

7

|

|

|

|

|

|

8

|

|

|

|

|

|

9

|

|

|

|

|

|

9

|

|

|

|

|

|

9

|

|

|

|

|

|

9

|

|

|

|

|

|

9

|

|

|

|

|

|

10

|

|

|

|

|

|

11

|

|

|

|

|

|

12

|

|

|

|

|

|

12

|

|

|

|

|

|

13

|

|

|

|

|

|

13

|

|

|

|

|

|

|

|

|

|

|

|

15

|

|

|

|

|

|

|

|

|

|

|

|

18

|

|

|

|

|

|

18

|

|

|

|

|

|

31

|

|

|

|

|

|

32

|

|

|

|

|

|

33

|

|

|

|

|

|

35

|

|

|

|

|

|

36

|

|

|

|

|

|

37

|

|

|

|

|

|

37

|

|

|

|

|

|

38

|

|

|

|

|

|

42

|

|

|

|

|

|

42

|

|

|

|

|

|

44

|

|

|

|

|

|

|

|

|

|

|

|

45

|

|

|

|

|

|

|

|

|

|

|

|

46

|

|

|

|

|

|

|

|

|

|

|

|

55

|

|

|

|

|

|

55

|

|

|

|

|

|

59

|

|

|

|

|

|

|

|

|

|

|

|

A-1

|

|

i

WYNDHAM WORLDWIDE

CORPORATION

PROXY

STATEMENT

The enclosed proxy materials are provided to you at the request

of the Board of Directors of Wyndham Worldwide Corporation

(Board) to encourage you to vote your shares at our 2009 annual

meeting of shareholders. This proxy statement contains

information on matters that will be presented at the meeting and

is provided to assist you in voting your shares. References in

this proxy statement to “we,” “us,”

“our,” and “Wyndham Worldwide” refer to

Wyndham Worldwide Corporation and our consolidated subsidiaries.

Our Board made these materials available to you over the

Internet or, upon your request, mailed you printed versions of

these materials in connection with our 2009 annual meeting. We

will mail a Notice of Internet Availability of Proxy Materials

(Notice) to our shareholders beginning on or about April 2,

2009 and will post our proxy materials on our website referenced

in the Notice on that same date. We are, on behalf of our Board,

soliciting your proxy to vote your shares at our 2009 annual

meeting of shareholders. We solicit proxies to give all

shareholders of record an opportunity to vote on matters that

will be presented at the annual meeting. In this proxy

statement, you will find information on these matters, which is

provided to assist you in voting your shares.

When and where

will the annual meeting be held?

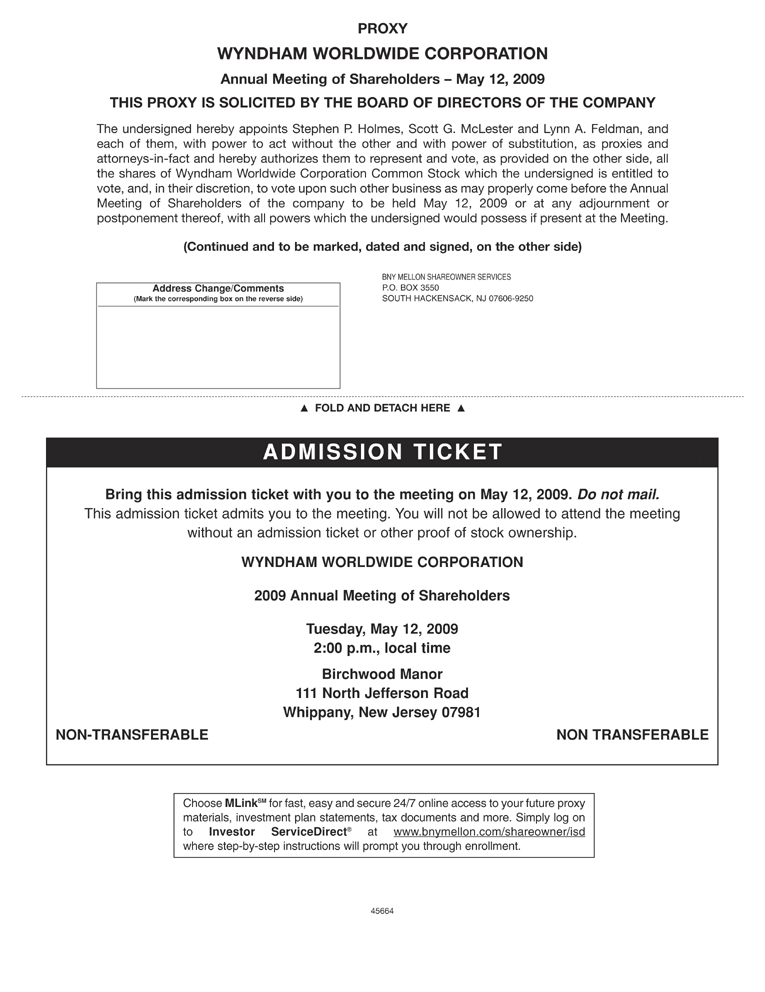

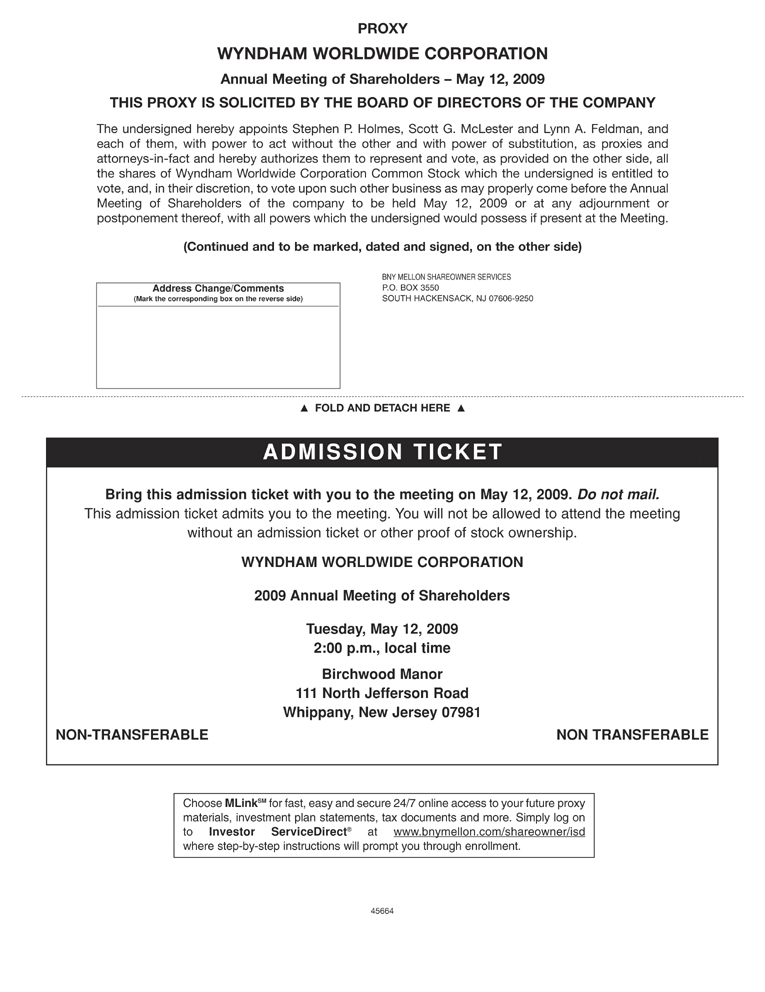

The annual meeting will be held on May 12, 2009 at

2:00 p.m. local time at Birchwood Manor, 111 North

Jefferson Road, Whippany, New Jersey 07981.

What are

shareholders being asked to vote on at the meeting?

You are being asked to vote on the following:

|

|

| •

|

the election of three directors for a three-year term;

nominations for director must comply with our by-laws including

the applicable notice requirements;

|

| |

| •

|

the ratification of the appointment of Deloitte &

Touche LLP to serve as our independent registered public

accounting firm for fiscal year 2009;

|

| |

| •

|

to approve the amendment and restatement of the Wyndham

Worldwide Corporation 2006 Equity and Incentive Plan primarily

for purposes of Section 162(m) of the Internal Revenue Code;

|

| |

| •

|

to consider two shareholder proposals, if properly presented at

the meeting; and

|

| |

| •

|

to transact any other business that may be properly brought

before the meeting or any adjournment or postponement of the

meeting.

|

We are not aware of any other matters that will be brought

before the shareholders for a vote at the annual meeting. If any

other matters are properly presented for a vote, the individuals

named as proxies will have discretionary authority, to the

extent permitted by law, to vote on such matters according to

their best judgment.

Who may vote and

how many votes does a shareholder have?

All holders of record of our common stock as of the close of

business on March 16, 2009 (record date) are entitled to

vote at the meeting. Each shareholder will have one vote for

each share of our common stock held as of the close of business

on the record date. As of the record date,

178,077,214 shares of

1

our common stock were outstanding. There is no cumulative voting

and the holders of our common stock vote together as a single

class.

How many votes

must be present to hold the meeting?

The holders of a majority of the outstanding shares of our

common stock entitled to vote at the meeting, or

89,038,608 shares, must be present, in person or by proxy,

at the meeting in order to constitute a quorum necessary to

conduct the meeting. Abstentions and broker non-votes will be

counted for the purposes of establishing a quorum at the meeting.

We urge you to vote by proxy even if you plan to attend the

meeting so that we will know as soon as possible that a quorum

has been achieved.

How do I

vote?

Even if you plan to attend the meeting you are encouraged to

vote by proxy.

If you are a shareholder of record, also known as a registered

shareholder, you may vote by proxy in one of the following ways:

|

|

| •

|

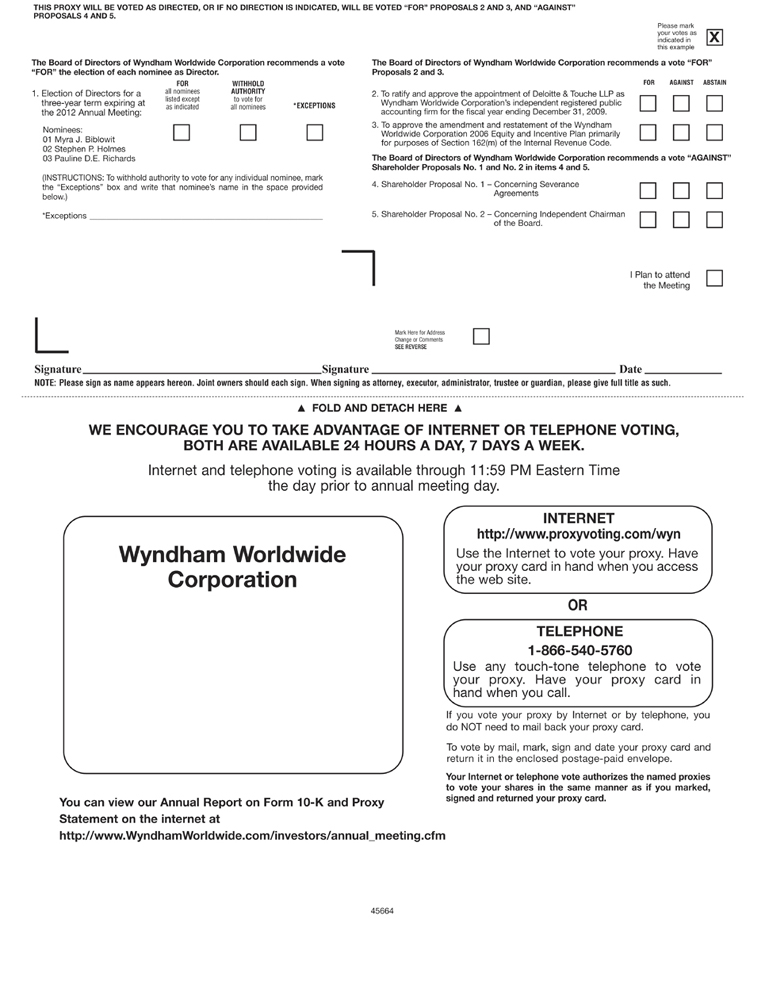

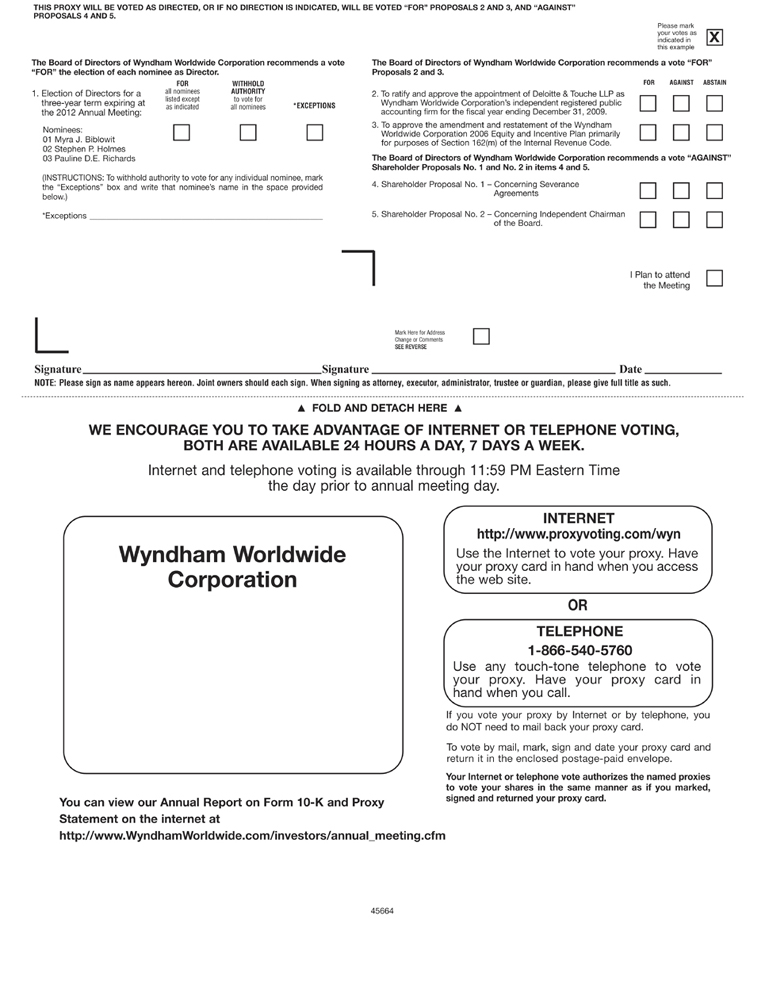

by telephone by calling the toll-free number

(866) 540-5760

(have your Notice or proxy card in hand when you call);

|

| |

| •

|

by Internet at

http://www.proxyvoting.com/wyn

(have your Notice or proxy card in hand when you access the

website);

|

| |

| •

|

if you received (or requested and received) a printed copy of

the annual meeting materials, by returning the enclosed proxy

card (signed and dated) in the envelope provided; or

|

| |

| •

|

in person at the annual meeting (please see below under

“How do I attend the meeting?”).

|

If your shares are registered in the name of a bank, broker or

other nominee, follow the proxy instructions on the form you

receive from the nominee. The availability of telephone and

Internet proxy will depend on the nominee’s proxy

processes. You may also vote in person at the annual meeting

(please see below under “How do I attend the

meeting?”).

When you vote by proxy, your shares will be voted according to

your instructions. If you sign your proxy card, vote by Internet

or by telephone, but do not specify how you want your shares to

be voted, they will be voted as the Board recommends.

For participants in the Wyndham Worldwide Corporation Employee

Savings Plan, with shares of our common stock credited to their

accounts, voting instructions for the trustees of the plan are

also being solicited through this proxy statement. In accordance

with the provisions of the plan, the trustee will vote shares of

our common stock in accordance with instructions received from

the participants to whose accounts the shares are credited.

How does the

Board recommend that I vote?

The Board recommends the following votes:

|

|

| •

|

FOR the election of each of the director nominees;

|

| |

| •

|

FOR the ratification of the appointment of Deloitte &

Touche LLP to serve as our independent registered public

accounting firm for fiscal year 2009;

|

2

|

|

| •

|

FOR approval of the amendment and restatement of the Wyndham

Worldwide Corporation 2006 Equity and Incentive Plan primarily

for purposes of Section 162(m) of the Internal Revenue

Code; and

|

| |

| •

|

AGAINST the two shareholder proposals.

|

How many votes

are required to approve each proposal?

In the election of directors, the affirmative vote of a

plurality of the votes present in person or by proxy and

entitled to vote at the meeting is required. In other words, the

director nominees receiving the greatest number of votes will be

elected. Abstentions will have no effect on the outcome of the

vote.

For all other proposals, the affirmative vote of the holders of

a majority of the shares represented at the meeting in person or

by proxy and entitled to vote on the proposal will be required

for approval. An abstention will have the effect of a vote

against any of these proposals.

If your shares are registered in the name of a bank, broker or

other nominee and you do not give your broker or other nominee

specific voting instructions for your shares, under rules of the

New York Stock Exchange your record holder has discretion to

vote your shares on proposals relating to what are deemed to be

“routine” matters, which include the election of

directors and the ratification of auditors, and do not have

discretion to vote on proposals relating to what are deemed to

be “non-routine” matters, which include the approval

of the amendment and restatement of the Wyndham Worldwide

Corporation 2006 Equity and Incentive Plan primarily for

purposes of Section 162(m) of the Internal Revenue Code of

1986, as amended (Code) and the shareholder proposals.

A “broker non-vote” occurs when a broker or other

nominee submits a proxy that states that the broker does not

vote for some or all of the proposals, because the broker has

not received instructions from the beneficial owner on how to

vote on the proposals and does not have discretionary authority

to vote in the absence of instructions. Although broker

non-votes will be considered as represented for purposes of

determining a quorum, broker non-votes are not counted in the

tabulation of the voting results. Thus, a broker non-vote will

make a quorum more readily obtainable and will not count as a

vote against a proposal that requires a majority of the votes

represented at the meeting.

How do I attend

the meeting?

If you received (or requested and received) a printed copy of

the proxy materials, you should bring the enclosed Admission

Ticket to gain admission to the meeting. If you received a

Notice or voting instructions and will not be requesting a

printed copy of the proxy materials, please bring the Notice or

voting instructions with you as your Admission Ticket. You must

bring with you a picture identification such as a valid

driver’s license or passport for purposes of personal

identification.

If your shares are held in the name of a broker, trust, bank or

other nominee, you will also need to bring a proxy, letter or

recent account statement from that broker, trust, bank or

nominee that confirms that you are the beneficial owner of those

shares.

Can I change or

revoke my vote?

You may change or revoke your proxy at any time prior to the

voting at the meeting by submitting a later dated proxy, by

entering new instructions by Internet or telephone, by giving

timely written notice of such change or revocation to the

Corporate Secretary or by attending the meeting and voting in

person and requesting that your prior proxy not be used.

How are proxies

solicited?

Georgeson Inc. has been retained to assist in soliciting proxies

at a cost of $9,000 plus reasonable expenses. Proxies may also

be solicited by our officers, directors and employees

personally, by mail,

3

telephone or other electronic means. We will pay all costs

relating to the solicitation of proxies. We will also reimburse

brokers, custodians, nominees and fiduciaries for reasonable

expenses in forwarding proxy materials to beneficial owners of

our common stock.

How do I make a

shareholder proposal for the 2010 meeting?

Shareholders interested in presenting a proposal for inclusion

in our proxy statement and proxy relating to our 2010 Annual

Meeting of Shareholders may do so by following the procedures

prescribed in

Rule 14a-8

under the Securities Exchange Act of 1934, as amended, and our

By-Laws. To be eligible for inclusion in next year’s proxy

statement, shareholder proposals must be received by the

Corporate Secretary at our principal executive offices no later

than the close of business on November 14, 2009. In

general, any shareholder proposal to be considered at next

year’s annual meeting, but not included in the proxy

statement, must be submitted in writing to and received by the

Corporate Secretary at our principal executive offices not

earlier than the close of business on December 26, 2009 and

not later than the close of business on January 25, 2010.

However, if the date of the 2010 Annual Meeting of Shareholders

is not within 30 days before or after May 12, 2010,

then a shareholder will be able to submit a proposal for

consideration at the annual meeting not later than the

10th day following the day on which public disclosure of

the date of the annual meeting was made or such notice of the

date of such annual meeting was mailed, whichever occurs first.

Any notification to bring any proposal before the 2009 Annual

Meeting of Shareholders must comply with the requirements of our

By-Laws. A shareholder may obtain a copy of our By-Laws on our

website or by writing to our Corporate Secretary.

Our Corporate Governance Committee will take into consideration

nominees for election to the Board submitted by shareholders in

accordance with the criteria and procedures described in this

proxy statement under Director Nomination Process. The Corporate

Governance Committee will also consider shareholder

recommendations for candidates to the Board sent to the

Committee

c/o the

Corporate Secretary. In order to submit a nomination or a

recommendation, a shareholder must comply with provisions of

applicable law and our By-Laws.

4

GOVERNANCE OF THE

COMPANY

Strong corporate governance is an integral part of our core

values. Our Board is committed to having sound corporate

governance principles and practices. Please visit our website at

www.WyndhamWorldwide.com under the Corporate Governance

page for the Board’s Corporate Governance Guidelines and

Director Independence Criteria, the Board-approved charters for

the Audit, Compensation and Corporate Governance Committees and

related information. These guidelines and charters may be

obtained by writing to our Corporate Secretary at Wyndham

Worldwide Corporation, 22 Sylvan Way, Parsippany, New Jersey

07054.

Corporate

Governance Guidelines

Our Board has adopted Corporate Governance Guidelines that,

along with the charters of the Board Committees, Director

Independence Criteria and Code of Business Conduct and Ethics

for Directors, provide the framework for our governance. The

governance rules for companies listed on the New York Stock

Exchange and those contained in the Sarbanes-Oxley Act of 2002

and related regulations are reflected in the guidelines. The

Board will review these principles and other aspects of

governance periodically. The Corporate Governance Guidelines are

available on the Corporate Governance page of our website at

www.WyndhamWorldwide.com.

Director

Independence Criteria

The Board adopted the Director Independence Criteria set out

below for its evaluation of the materiality of director

relationships with us. The Director Independence Criteria

contain independence standards that exceed the independence

standards specified in the listing standards of the New York

Stock Exchange. The Director Independence Criteria are available

on the Corporate Governance page of our website at

www.WyndhamWorldwide.com.

A director who satisfies all of the following criteria shall be

presumed to be independent under our Director Independence

Criteria:

|

|

|

|

•

|

|

Wyndham Worldwide Corporation does not currently employ, and has

not within the last three years employed, the director or any of

his or her immediate family members (except, in the case of

immediate family members, in a non-executive officer capacity). |

| |

|

•

|

|

The director is not currently, and has not within the last three

years been, employed by Wyndham Worldwide Corporation’s

present auditors, nor has any of his or her immediate family

members been so employed (except in non-professional capacity

not involving Wyndham Worldwide Corporation’s business). |

| |

|

•

|

|

Neither the director, nor any of his or her immediate family

members, is, or has been within the last three years, part of an

“interlocking directorate” in which an executive

officer of Wyndham Worldwide Corporation serves on the

compensation (or equivalent) committee of another company that

employs the director or his or her immediate family member as an

executive officer. |

| |

|

•

|

|

The director is not a current employee, nor is an immediate

family member a current executive officer, of a company that has

made payments to, or received payments from, Wyndham Worldwide

Corporation for property or services in an amount in any of the

last three fiscal years, exceeding the greater of $750,000 or 1%

of such other company’s consolidated gross revenues. |

| |

|

•

|

|

The director currently does not have, or had within the past

three years, a personal services contract with Wyndham Worldwide

Corporation, its Chairman and Chief Executive Officer or other

executive officer. |

5

|

|

|

|

•

|

|

The director has not received, and such director’s

immediate family member has not received, during any

twelve-month period within the last three years, more than

$100,000 in direct compensation from Wyndham Worldwide

Corporation (other than Wyndham Worldwide Corporation Board of

Director fees). |

| |

|

•

|

|

The director is not currently an officer or director of a

foundation, university or other non-profit organization to which

Wyndham Worldwide Corporation within the last three years gave

directly or indirectly through the provision of services, more

than the greater of (i) 1% of the consolidated gross

revenues of such organization during any single fiscal year or

(ii) $100,000. |

Guidelines for

Determining Director Independence

Our Corporate Governance Guidelines and Director Independence

Criteria provide for director independence standards that meet

or exceed those of the New York Stock Exchange. These standards

require the Board to affirmatively determine that each director

has no material relationship with Wyndham Worldwide other than

as a director.

In accordance with these standards and criteria, the Board

undertook its annual review of the independence of its

directors. During this review, the Board considered whether

there are any relationships between each director or any member

of his or her immediate family and us and our subsidiaries and

affiliates. The Board also considered whether there were any

transactions or relationships between directors or any member of

their immediate family or any entity of which a director or an

immediate family member is an executive officer, general partner

or significant equity holder and us. The purpose of this review

was to determine whether any such relationships or transactions

existed that were inconsistent with a determination that the

director is independent.

As a result of this review, the Board affirmatively determined

that the following directors are independent of us and our

management as required by the New York Stock Exchange listing

standards and the Director Independence Criteria: Myra J.

Biblowit, George Herrera, The Right Honourable Brian Mulroney,

Pauline D.E. Richards and Michael H. Wargotz. Under New York

Stock Exchange rules, Mr. Buckman, as a former executive

officer of our former parent corporation, Cendant Corporation

(now Avis Budget Group), may not be deemed to be independent

until August 2009, three years from the effective date of the

spin-off. All members of the Audit, Compensation and Corporate

Governance Committees are independent directors as required by

the New York Stock Exchange listing standards, Securities and

Exchange Commission (SEC) rules as applicable and the Director

Independence Criteria.

The Board follows a number of procedures to review, and if

necessary and appropriate, ratify related party transactions. We

maintain a written policy governing related party transactions

that requires Board approval of related party transactions

exceeding $10,000. Each Board member answers a questionnaire

designed to disclose conflicts and related party transactions.

We also review our internal records for related party

transactions. Based on a review of these standards and

materials, none of the directors determined by the Board to be

independent had or has any relationship with us other than as a

director. Accordingly, the Board did not need to consider any

director relationship with us to make its determination of

director independence.

6

Committees of the

Board

The following describes our Board Committees. The composition of

the Committees is provided immediately after.

Audit

Committee

Responsibilities include:

|

|

|

|

•

|

|

Appoints our independent registered public accounting firm,

subject to shareholder ratification, to perform an integrated

audit of our consolidated financial statements and internal

control over financial reporting. |

| |

|

•

|

|

Pre-approves all services performed by our independent

registered public accounting firm. |

| |

|

•

|

|

Provides oversight on the external reporting process and the

adequacy of our internal controls. |

| |

|

•

|

|

Reviews the scope, planning, staffing and budgets of the audit

activities of the independent registered public accounting firm

and our internal auditors and evaluates audit efforts of both,

including reviews of reports. |

| |

|

•

|

|

Reviews services provided by our independent registered public

accounting firm and other disclosed relationships as they bear

on the independence of our independent registered public

accounting firm and establishes clear hiring policies with

respect to employees or former employees of the independent

auditor. |

| |

|

•

|

|

Reviews the Code of Business Conduct and Ethics and related

compliance activities. |

| |

|

•

|

|

Establishes procedures for the receipt, retention and resolution

of complaints regarding accounting, internal controls or

auditing matters. |

All members of the Audit Committee are independent directors

under the Board’s Director Independence Criteria and

applicable regulatory and listing standards. The Board in its

business judgment has determined that each member of the Audit

Committee is financially literate, knowledgeable and qualified

to review financial statements in accordance with applicable

listing standards. The Board has also determined that both

Pauline D.E. Richards and Michael H. Wargotz are audit committee

financial experts within the meaning of applicable SEC rules.

See the Audit Committee Report below. The Audit Committee

Charter is available on the Corporate Governance page of our

website at www.WyndhamWorldwide.com.

Compensation

Committee

Responsibilities include:

|

|

|

|

•

|

|

Establishes executive compensation policy consistent with

corporate objectives and shareholder interests. |

| |

|

•

|

|

Reviews and approves elements of CEO and other senior management

compensation. |

| |

|

•

|

|

Approves equity grants under our compensation plans. |

All members of the Compensation Committee are independent

directors under the Board’s Director Independence Criteria

and applicable regulatory and listing standards.

7

See the Compensation Committee Report below. The Compensation

Committee Charter is available on the Corporate Governance page

on our website at www.WyndhamWorldwide.com.

Corporate

Governance Committee

Responsibilities include:

|

|

|

|

•

|

|

Recommends to the Board nominees for election to the Board. |

| |

|

•

|

|

Reviews principles, policies and procedures affecting directors

and the Board’s operation and effectiveness. |

| |

|

•

|

|

Oversees evaluation of the Board and its effectiveness. |

| |

|

•

|

|

Reviews and approves director compensation. |

All members of the Corporate Governance Committee are

independent directors under the Board’s Director

Independence Criteria and applicable regulatory and listing

standards.

The Corporate Governance Committee Charter is available on the

Corporate Governance page on our website at

www.WyndhamWorldwide.com.

Executive

Committee

The Executive Committee may exercise all of the authority of the

Board when the Board is not in session, including the

authorization of the issuance of stock, except that the

Executive Committee does not have the authority to alter, amend

or repeal the by-laws or any resolution or resolutions of the

Board, declare any dividend or make any other distribution to

shareholders, appoint any member of the Executive Committee or

take any other action which legally may be taken only by the

full Board.

Committee

Membership

The following chart shows the current committee membership and

the number of meetings that each committee held since

January 1, 2008.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit

|

|

|

Compensation

|

|

|

Governance

|

|

|

Executive

|

|

Director

|

|

|

Committee

|

|

|

Committee

|

|

|

Committee

|

|

|

Committee

|

|

Myra J. Biblowit

|

|

|

|

|

|

M

|

|

|

M

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James E. Buckman

|

|

|

|

|

|

|

|

|

|

|

|

M

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

George Herrera

|

|

|

M

|

|

|

|

|

|

C

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen P. Holmes

|

|

|

|

|

|

|

|

|

|

|

|

C

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Right Honourable Brian Mulroney

|

|

|

|

|

|

C

|

|

|

M

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pauline D.E. Richards

|

|

|

M

|

|

|

M

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael H. Wargotz

|

|

|

C

|

|

|

|

|

|

|

|

|

M

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Meetings in 2008

|

|

|

15

|

|

|

11

|

|

|

3

|

|

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M = Member

C = Chair

Directors fulfill their responsibilities not only by attending

Board and committee meetings but also through communication with

the Chairman and CEO and other members of management relative to

matters of mutual interest and concern to Wyndham Worldwide.

8

The Board held five meetings during 2008. Each director attended

at least 75% of the meetings of the Board and the committees of

the Board on which the director served.

Executive

Sessions of Non-Management Directors

The Board met three times during 2008 in executive session

without any members of management present, whether or not they

are directors. The Board met once during 2008 in executive

session with only independent directors present. Directors

meeting in executive session select a presiding director for

each executive session.

Communications

with the Board and Directors

Shareholders and other parties interested in communicating

directly with the Board, an individual non-employee director or

the non-employee directors as a group may do so by writing our

Corporate Secretary at Wyndham Worldwide Corporation, 22 Sylvan

Way, Parsippany, New Jersey 07054. The Corporate Secretary will

forward the correspondence only to the intended recipients.

However, prior to forwarding any correspondence, the Corporate

Secretary will review it and, in her discretion, not forward

correspondence deemed to be of a commercial nature.

Code of Business

Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics for

Directors with ethics guidelines specifically applicable to

directors. In addition, we adopted Business Principles

applicable to all our employees, including our CEO, CFO and

Chief Accounting Officer. The Code of Business Conduct and

Ethics for Directors and our Business Principles are available

on the Corporate Governance page of our website at

www.WyndhamWorldwide.com. Copies of these documents may

also be obtained free of charge by writing to our Corporate

Secretary. We will disclose on our website any amendment to or

waiver from a provision of our Business Principles that applies

to our CEO, CFO or Chief Accounting Officer.

Director

Attendance at Annual Meeting of Shareholders

As provided in the Board’s Corporate Governance Guidelines,

directors are expected to attend our annual meeting of

shareholders absent exceptional cause. All of our directors

attended our 2008 annual meeting and are expected to attend the

2009 annual meeting.

Director

Nomination Process

Role of Corporate Governance Committee. The

Corporate Governance Committee considers the appropriate balance

of experience, skills and characteristics required of the Board

when considering potential candidates to serve on the Board.

Nominees for director are selected on the basis of their depth

and breadth of experience, wisdom, integrity, ability to make

independent analytical inquiries, understanding of our business

environment and willingness to devote adequate time to Board

duties.

Identification and Evaluation Process. The

process for identifying and evaluating nominees to the Board is

initiated by identifying a candidate who meets the criteria for

selection as a nominee and has the specific qualities or skills

being sought based on input from members of the Board and, if

the Corporate Governance Committee deems appropriate, a

third-party search firm. These candidates will be evaluated by

the Corporate Governance Committee by reviewing the

candidates’ biographical information and qualifications and

checking the candidates’ references. Qualified nominees

will be interviewed by at least one member of the Corporate

Governance Committee. Using the input from the interview and

other information obtained by the Corporate Governance

Committee, the Corporate Governance Committee evaluates whether

the prospective candidate is qualified to

9

serve as a director and whether the Corporate Governance

Committee should recommend to the Board that the Board nominate

the prospective candidate for election by the shareholders or to

fill a vacancy on the Board.

Shareholder Nominations and By-Law

Procedures. The Corporate Governance Committee

will consider written proposals from shareholders for nominees

for director. Nominations should be submitted to the Corporate

Governance Committee,

c/o the

Corporate Secretary, and include at least the following: name of

the shareholder and evidence of the person’s ownership of

our common stock, number of shares owned and the length of time

of ownership, name of the candidate, the candidate’s resume

or a listing of his or her qualifications to be a director and

the person’s consent to be named as a director if selected

by the Corporate Governance Committee and nominated by the Board.

Our By-Laws establish procedures pursuant to which a shareholder

may nominate a person for election to the Board. Our By-Laws are

posted on our website under Corporate Governance at

www.WyndhamWorldwide.com. To nominate a person for

election to the Board, a shareholder must set forth all

information relating to the nominee that is required to be

disclosed in a proxy statement or other filings required to be

made in connection with solicitations of proxies for election of

directors or is otherwise required in each case pursuant to

Section 14 under the Securities Exchange Act of 1934, as

amended (and the related rules and regulations). Such notice

must also contain information specified in the By-Laws as to the

director nominee, information about the shareholder making the

nomination, including name and address, number of shares owned,

and representations regarding the intention to make such a

nomination and to solicit proxies in support of it. We may

require any proposed nominee to furnish information concerning

his or her eligibility to serve as an independent director or

that could be material to a reasonable shareholder’s

understanding of the independence of the nominee.

To nominate a person for election to the Board at our annual

meeting of shareholders, written notice of a shareholder

nomination must be delivered to our Corporate Secretary not less

than 90 nor more than 120 days prior to the anniversary

date of the prior year’s annual meeting. However, if our

annual meeting is advanced or delayed by more than 30 days

from the anniversary date of the previous year’s meeting, a

shareholder’s written notice will be timely if it is

delivered by no later than the close of business on the

10th day following the day on which public disclosure of

the date of the annual meeting is made or the notice of the date

of the annual meeting was mailed, whichever occurs first. A

shareholder may make nominations of persons for election to the

Board at a special meeting if the shareholder delivers written

notice to our Corporate Secretary not later than the close of

business on the 10th day following the day on which public

disclosure of the date such special meeting was made or notice

of such special meeting was mailed, whichever occurs first. At a

special meeting of shareholders, only such business may be

conducted as shall have been brought before the meeting pursuant

to our notice of meeting.

Evaluation of Shareholder Recommendations of

Nominees. The Corporate Governance Committee

intends to use a substantially similar evaluation process as

discussed above to evaluate nominees for director recommended by

shareholders.

Audit Committee

Report

The Audit Committee of the Board of Directors assists the Board

in fulfilling its oversight responsibilities for the external

reporting process and the adequacy of Wyndham Worldwide’s

internal controls. Specific responsibilities of the Audit

Committee are set forth in the Audit Committee Charter adopted

by the Board on July 13, 2006. The Charter is available on

the Corporate Governance page of our website at

www.WyndhamWorldwide.com.

The Audit Committee is comprised of three directors, all of whom

meet the standards of independence adopted by the New York Stock

Exchange and the SEC. Subject to shareholder ratification, the

Audit

10

Committee appoints Wyndham Worldwide’s independent

registered public accounting firm. The Audit Committee approves

in advance all services to be performed by Wyndham

Worldwide’s independent registered public accounting firm

in accordance with SEC rules, subject to the de minimis

exceptions for non-audit services.

Management is responsible for Wyndham Worldwide’s financial

statements and reporting process, for establishing and

maintaining adequate internal controls over financial reporting,

and for assessing the effectiveness of Wyndham Worldwide’s

internal controls over financial reporting. Deloitte &

Touche LLP, Wyndham Worldwide’s independent registered

public accounting firm, is responsible for the integrated audit

of Wyndham Worldwide’s consolidated financial statements

and internal control over financial reporting. The Audit

Committee has reviewed and discussed Wyndham Worldwide’s

2008 annual report on

Form 10-K,

including the audited consolidated financial statements of

Wyndham Worldwide for the year ended December 31, 2008,

with management and with representatives of Deloitte &

Touche LLP.

The Audit Committee has also discussed with Deloitte &

Touche LLP matters required to be discussed by applicable

standards of the Public Company Accounting Oversight Board

(“PCAOB”), including Statement on Auditing Standards

No. 61, “Communication with Audit

Committees”, as amended, and as adopted by the PCAOB,

as well as

Rule 2-07

of

Regulation S-X

of the SEC — Communication with audit committees.

The Audit Committee has received from Deloitte &

Touche LLP the written disclosures required by applicable

standards of the PCAOB regarding Deloitte & Touche

LLP’s independence, and has discussed with

Deloitte & Touche LLP its independence.

The Audit Committee has also considered whether

Deloitte & Touche LLP providing limited non-audit

services to Wyndham Worldwide is compatible with maintaining its

independence. The Audit Committee has satisfied itself as to the

independence of Deloitte & Touche LLP.

Based on the Audit Committee’s review of the audited

consolidated financial statements of Wyndham Worldwide and

management’s annual report on internal control over

financial reporting, and on the Audit Committee’s

discussions with management of Wyndham Worldwide and with

Deloitte & Touche LLP, the Audit Committee recommended

to the Board of Directors that the audited consolidated

financial statements and management’s annual report on

internal control over financial reporting be included in Wyndham

Worldwide’s Annual Report on

Form 10-K

for the year ended December 31, 2008.

AUDIT COMMITTEE

Michael H. Wargotz (Chair)

George Herrera

Pauline D.E. Richards

Compensation of

Directors

Non-employee directors receive compensation for Board service

designed to compensate directors for their Board

responsibilities and align their interests with the long-term

interests of shareholders. An employee director receives no

additional compensation for Board service.

11

The following table describes compensation for non-employee

directors for 2008.

2008 Director

Compensation

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees Paid

|

|

|

Stock

|

|

|

Option

|

|

|

All Other

|

|

|

|

Name

|

|

|

in Cash

|

|

|

Awards

|

|

|

Awards

|

|

|

Compensation

|

|

|

Total

|

|

|

|

($)

|

|

|

($)(a)(b)(c)

|

|

|

($)(a)(d)

|

|

|

($)(e)(f)

|

|

|

($)

|

|

Myra J. Biblowit

|

|

|

|

81,319

|

|

|

|

|

81,208

|

|

|

|

|

--

|

|

|

|

|

8,383

|

|

|

|

|

|

170,910

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James E. Buckman

|

|

|

|

79,028

|

|

|

|

|

78,984

|

|

|

|

|

--

|

|

|

|

|

15

|

|

|

|

|

|

158,027

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

George Herrera

|

|

|

|

85,048

|

|

|

|

|

84,974

|

|

|

|

|

--

|

|

|

|

|

8,359

|

|

|

|

|

|

178,381

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Right Honourable Brian Mulroney

|

|

|

|

--

|

|

|

|

|

170,006

|

|

|

|

|

--

|

|

|

|

|

2,007

|

|

|

|

|

|

172,013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pauline D.E. Richards

|

|

|

|

83,801

|

|

|

|

|

83,701

|

|

|

|

|

--

|

|

|

|

|

10

|

|

|

|

|

|

167,512

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael H. Wargotz

|

|

|

|

89,047

|

|

|

|

|

88,972

|

|

|

|

|

--

|

|

|

|

|

23

|

|

|

|

|

|

178,042

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

Represents amounts recognized for

financial statement reporting purposes for 2008 for outstanding

deferred stock units in accordance with Financial Accounting

Standards Board Statement of Financial Accounting Standards

No. 123 (revised 2004) Share-Based Payment

(SFAS No. 123(R)). A discussion of the assumptions

used in calculating these values may be found in Note 17 to

our 2008 audited financial statements of our annual report on

Form 10-K.

|

| |

|

(b)

|

|

Shares of our common stock issuable

for deferred stock units at December 31, 2008 are as

follows: Ms. Biblowit, 17,416; Mr. Buckman, 11,296;

Mr. Herrera, 15,149; Mr. Mulroney, 37,194;

Ms. Richards, 17,185; and Mr. Wargotz, 12,424.

|

| |

|

(c)

|

|

Includes deferred stock units

credited for dividends paid on deferred stock units outstanding

on the record date for such dividends.

|

| |

|

(d)

|

|

Shares of our common stock which

the directors have the right to acquire through the exercise of

stock options (converted from Cendant stock options in

connection with the spin-off) as of December 31, 2008 are

as follows: Ms. Biblowit, 22,932; Mr. Buckman,

501,175; and Mr. Mulroney, 12,508.

|

| |

|

(e)

|

|

Includes charitable matching

contributions made on behalf of the director as follows:

Ms. Biblowit, $8,375; Mr. Herrera, $8,335; and

Mr. Mulroney, $2,000.

|

| |

|

(f)

|

|

Includes nominal residual cash

balance due to dividend fractional shares.

|

2009 Director

Compensation

The following describes compensation we will pay our

non-employee directors in 2009:

| |

|

|

|

|

|

Annual director retainer

|

|

$

|

150,000

|

|

|

Audit Committee chair

|

|

|

20,000

|

|

|

Audit Committee member

|

|

|

10,000

|

|

|

Compensation Committee chair

|

|

|

15,000

|

|

|

Compensation Committee member

|

|

|

7,500

|

|

|

Corporate Governance Committee chair

|

|

|

10,000

|

|

|

Corporate Governance Committee member

|

|

|

5,000

|

|

|

Executive Committee member

|

|

|

8,000

|

|

The annual director retainer and committee chair and membership

fees are paid on a quarterly basis 50% in cash and 50% in

deferred stock units. The number of deferred stock units issued

is based on our stock price on the quarterly determination date.

Directors may elect to receive more than 50% of the retainer and

fees in deferred stock units. Board members do not receive

additional fees for meeting attendance.

We make available to each director a term life insurance policy

owned by us with a $1.1 million death benefit payable

$1 million to us, which benefit we will donate to a

charitable beneficiary of the director’s choice, and

$100,000 paid directly to a personal beneficiary of the

director’s choice. In the event we undergo a

change-in-control

or a director retires, we will pay the premiums for the policies

for one year from the date of the

change-in-control

or retirement as applicable. Directors are not required to use

this benefit and not all directors have opted to use the benefit.

12

We provide for a company match of a director’s qualifying

charitable contributions in an amount up to $10,000 per year.

We maintain a policy to make available to our directors the

right to use annually one week at a Wyndham Vacation Ownership

timeshare facility.

Stock Ownership

Guidelines

The Corporate Governance Guidelines require each non-employee

director to own at least 1,000 shares of our common stock.

Deferred stock units credited to a director count towards

satisfaction of the guidelines. As of December 31, 2008,

all of our non-employee directors met or exceeded the ownership

requirements.

Ownership of

Company Stock

The following table describes the beneficial ownership of our

common stock for the following persons as of December 31,

2008 (October 3, 2008 for Mr. Rudnitsky): each

executive officer named in the Summary Compensation Table below

(who we refer to in this proxy statement as named executive

officers), each director, each person who to our knowledge

beneficially owns in excess of 5% of our common stock; and all

of our directors and executive officers as a group. The

percentage values are based on 177,509,822 shares of our

common stock outstanding as of December 31, 2008. The

principal address for each director, nominee and executive

officer of Wyndham Worldwide is 22 Sylvan Way, Parsippany, New

Jersey 07054.

Under SEC rules, “beneficial ownership” includes

shares for which the individual, directly or indirectly, has or

shares voting or investment power, whether or not the shares are

held for the individual’s benefit.

| |

|

|

|

|

|

|

|

|

|

Name

|

|

Number of Shares

|

|

|

|

% of Class

|

|

Barrow, Hanley, Mewhinney & Strauss, Inc.

|

|

20,011,127

|

|

|

(a)

|

|

|

11.27%

|

|

Vanguard Windsor Funds — Vanguard

Windsor II Fund

|

|

18,272,274

|

|

|

(b)

|

|

|

10.29%

|

|

AXA Financial, Inc.

|

|

15,676,303

|

|

|

(c)

|

|

|

8.83%

|

|

Barclays Global Investors, N.A.

|

|

13,127,557

|

|

|

(d)

|

|

|

7.40%

|

|

Thomas F. Anderson

|

|

49,633

|

|

|

(e)(f)

|

|

|

*

|

|

Geoffrey A. Ballotti

|

|

0

|

|

|

(e)(g)(h)

|

|

|

*

|

|

Myra J. Biblowit

|

|

40,348

|

|

|

(f)(i)

|

|

|

*

|

|

James E. Buckman

|

|

558,220

|

|

|

(f)(i)(j)

|

|

|

*

|

|

Franz S. Hanning

|

|

259,800

|

|

|

(e)(f)(g)(h)

|

|

|

*

|

|

George Herrera

|

|

15,149

|

|

|

(i)

|

|

|

*

|

|

Stephen P. Holmes

|

|

1,172,035

|

|

|

(e)(f)(g)(h)(k)

|

|

|

*

|

|

The Right Honourable Brian Mulroney

|

|

49,702

|

|

|

(f)(i)

|

|

|

*

|

|

Pauline D.E. Richards

|

|

17,185

|

|

|

(i)

|

|

|

*

|

|

Steven A. Rudnitsky

|

|

266,723

|

|

|

(f)(g)

|

|

|

*

|

|

Michael H. Wargotz

|

|

13,146

|

|

|

(i)

|

|

|

*

|

|

Virginia M. Wilson

|

|

115,833

|

|

|

(e)(f)(g)(h)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group

(16 persons)

|

|

2,651,577

|

|

|

(l)

|

|

|

1.48%

|

|

|

|

|

*

|

|

Amount represents less than 1% of

outstanding common stock.

|

| |

|

(a)

|

|

Derived solely from information

reported in a Schedule 13G under the Securities Exchange

Act filed with the SEC on February 12, 2009 by Barrow,

Hanley, Mewhinney & Strauss, Inc. (Barrow). Such

Schedule 13G indicates that Barrow beneficially owns

20,011,127 shares of our common stock with sole voting

power over 1,522,527 shares, shared voting power over

18,488,600 shares, sole dispositive power over

20,011,127 shares and shared disposition power over no

shares. We believe that as of December 31, 2008, the

20,011,127 shares reported in the table above beneficially

owned by Barrow include a substantial portion of the shares

beneficially owned by Vanguard Windsor Funds —

Vanguard Windsor II Fund (Vanguard), for whom Barrow is an

investment manager. The principal business address for Barrow is

2200 Ross Avenue, 31st Floor, Dallas, Texas 75201.

|

| |

|

(b)

|

|

Derived solely from information

reported in an Amendment No. 3 to Schedule 13G under

the Securities Exchange Act filed with the SEC on

February 13, 2009 by Vanguard. Such Schedule 13G

indicates that Vanguard beneficially owns

|

13

|

|

|

|

|

|

18,272,274 shares of our

common stock with sole voting power over 18,272,274 shares,

shared voting power for no shares, sole investment power for no

shares and shared investment power for no shares. The principal

business address for Vanguard is 100 Vanguard Boulevard,

Malvern, Pennsylvania 19355.

|

| |

|

(c)

|

|

Derived solely from information

reported in an Amendment No. 2 to Schedule 13G under

the Securities Exchange Act filed with the SEC on

February 13, 2009 by AXA Financial, Inc. and certain

affiliates. Such Schedule 13G indicates that AXA Financial,

Inc. beneficially owns 15,676,303 shares of our common

stock with sole voting power over 12,288,498 shares, shared

voting power over no shares, sole dispositive power over

15,676,303 shares and shared dispositive power over no

shares. Such Schedule 13G further indicates that 15,669,708

of the shares reported are held by unaffiliated third-party

client accounts managed by AllianceBernstein L.P., as investment

adviser. AllianceBernstein L.P. is a majority-owned subsidiary

of AXA Financial, Inc. The principal business address for AXA

Financial, Inc. is 1290 Avenue of the Americas, New York, New

York 10104.

|

| |

|

(d)

|

|

Derived solely from information

reported in a Schedule 13G under the Securities Exchange

Act filed with the SEC on February 5, 2009 by Barclays

Global Investors, N.A. and certain affiliates. Such

Schedule 13G indicates that Barclays Global Investors, N.A.

beneficially owns 13,127,557 shares of our common stock

with sole voting power over 11,116,435 shares, shared

voting power over no shares, sole dispositive power over

13,127,557 shares and shared disposition power over no

shares. The principal business address for Barclays Global

Investors, N.A. is 400 Howard Street, San Francisco,

California 94015.

|

| |

|

(e)

|

|

Excludes shares of our common stock

issuable upon vesting of restricted stock units after

60 days from December 31, 2008 as follows:

Mr. Holmes, 101,970; Mr. Ballotti, 58,249;

Mr. Hanning, 119,138; Ms. Wilson, 74,423; and

Mr. Anderson, 46,244.

|

| |

|

(f)

|

|

Includes shares of our common stock

which the directors and named executive officers have the right

to acquire through the exercise of stock options within

60 days of December 31, 2008 (October 3, 2008 for

Mr. Rudnitsky) as follows: Ms. Biblowit, 22,932;

Mr. Buckman, 501,175; Mr. Holmes, 475,112;

Mr. Mulroney, 12,508; Mr. Hanning, 72,806;

Mr. Rudnitsky, 88,611; Ms. Wilson, 9,808; and

Mr. Anderson, 25,911.

|

| |

|

(g)

|

|

Includes shares of our common stock

which the named executive officers have the right to acquire

through the exercise of stock settled stock appreciation rights

within 60 days of December 31, 2008 (October 3,

2008 for Mr. Rudnitsky) as follows: Mr. Holmes,

305,021; Mr. Ballotti, 0; Mr. Hanning, 81,467;

Mr. Rudnitsky, 111,693; and Ms. Wilson, 67,440.

|

| |

|

(h)

|

|

Excludes shares of our common stock

which the named executive officers did not have the right to

acquire through the exercise of stock settled stock appreciation

rights within 60 days of December 31, 2008 as follows:

Mr. Holmes, 735,343; Mr. Ballotti, 63,617;

Mr. Hanning, 124,588; and Ms. Wilson, 82,507.

|

| |

|

(i)

|

|

Includes shares of our common stock

issuable for deferred stock units as of December 31, 2008

as follows: Ms. Biblowit, 17,416; Mr. Buckman, 11,296;

Mr. Herrera, 15,149; Mr. Mulroney, 37,194;

Ms. Richards, 17,185; and Mr. Wargotz, 12,424.

|

| |

|

(j)

|

|

Includes 3,220 shares held in

Mr. Buckman’s IRA account. Includes 27,069 previously

deferred shares of common stock settled in cash in February 2009

by Avis Budget Group, Inc.

|

| |

|

(k)

|

|

Includes 3,394 shares held by

Mr. Holmes’ children and 22,000 shares held in

charitable trust. Includes 91,955 previously deferred shares of

common stock issued to Mr. Holmes in February 2009.

|

| |

|

(l)

|

|

Includes or excludes, as the case

may be, shares of common stock as indicated in the preceding

footnotes.

|

Section 16(a)

Beneficial Ownership Reporting Compliance

Our directors and executive officers are required to file with

the SEC reports of ownership and changes in ownership of our

common stock. In 2008, all reports were filed on time.

14

ELECTION OF

DIRECTORS

At the date of this proxy statement, the Board of Directors

consists of seven members, six of whom are non-employee

directors and five of whom are independent directors under

applicable listing standards and our corporate governance

documents. The Board is divided into three classes, each with

three-year terms. The terms of the classes are staggered so that

one-third of the directors, or as near to one-third as possible,

are elected at each annual meeting.

At this year’s meeting, three directors are to be elected

for three-year terms. The Corporate Governance Committee of the

Board has nominated Stephen P. Holmes, Myra J. Biblowit and

Pauline D.E. Richards. They are all presently our directors.

We do not know of any reason why any nominee would be unable to

serve as a director. If any nominee is unable to serve, the

shares represented by all valid proxies will be voted for the

election of such other person as the Board may nominate.

The three nominees and the other present directors continuing in

office after the meeting are listed below, with brief

biographies.

Nominees for

Election to the Board for a Three-Year Term

Expiring at the 2012 Annual Meeting

| |

|

|

|

|

Stephen P. Holmes, 52, has served as the Chairman of our

Board of Directors and as our Chief Executive Officer since our

separation from Cendant in July 2006. Mr. Holmes was a director

since May 2003 of the already-existing, wholly owned subsidiary

of Cendant that held the assets and liabilities of

Cendant’s hospitality services (including timeshare

resorts) businesses before our separation from Cendant and has

served as a director of Wyndham Worldwide since the separation

in July 2006. Mr. Holmes was Vice Chairman and Director of

Cendant and Chairman and Chief Executive Officer of

Cendant’s Travel Content Division from December 1997 until

our separation from Cendant in July 2006. Mr. Holmes was Vice

Chairman of HFS Incorporated, from September 1996 until December

1997 and was a director of HFS from June 1994 until December

1997. From July 1990 through September 1996, Mr. Holmes served

as Executive Vice President, Treasurer and Chief Financial

Officer of HFS.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Myra J. Biblowit, 60, has served as a director since our

separation from Cendant in July 2006. Ms. Biblowit was a Cendant

director from April 2000 until the completion of Cendant’s

separation plan in August 2006. Since April 2001, Ms. Biblowit

has been President of The Breast Cancer Research Foundation.

From July 1997 until March 2001, she served as Vice Dean for

External Affairs for the New York University School of Medicine

and Senior Vice President of the Mount

Sinai-NYU

Health System. From June 1991 to June 1997, Ms. Biblowit was

Senior Vice President and Executive Director of the Capital

Campaign for the American Museum of Natural History.

|

15

| |

|

|

|

|

Pauline D.E. Richards, 60, has served as a director since

our separation from Cendant in July 2006. Ms. Richards was a

Cendant director from March 2003 until the completion of

Cendant’s separation plan in August 2006. Since July 2008,

Ms. Richards has served as Chief Operating Officer of Brevan

Howard P&C Partners Limited, an investment management

company. From November 2003 to July 2008, Ms. Richards served as

Director of Development at the Saltus Grammar School, the